- The Litepaper by Stocktwits

- Posts

- Altcoins Pumping, Time To Unlock Trust Issues 🤔

Altcoins Pumping, Time To Unlock Trust Issues 🤔

Swing low or just a fakeout? It's still August, a month that sucks

OVERVIEW

Altcoins Pumping, Time To Unlock Trust Issues 🤔

Before we dive in, here’s today’s crypto market heatmap:

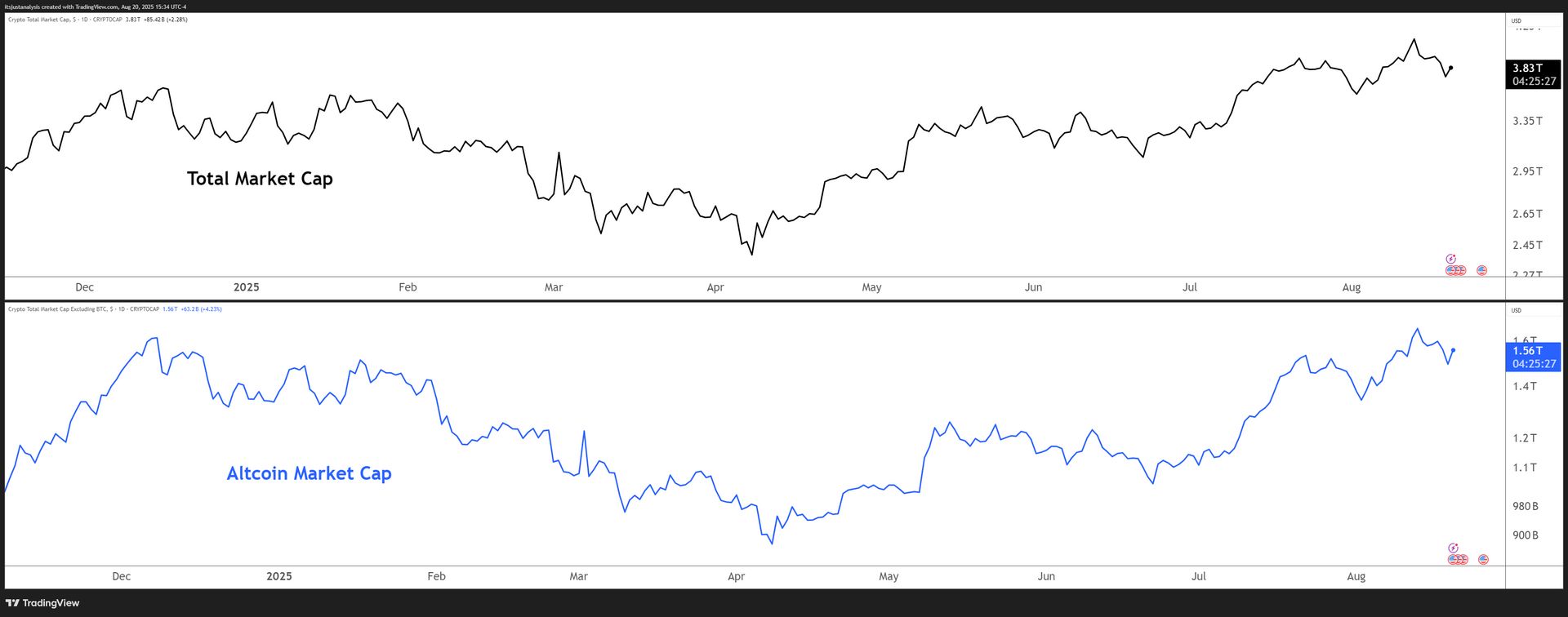

And here’s a look at crypto’s total market and altcoin market cap charts:

RWA TOKENIZATION

The Mooch Tokenizes $300,000,000 Of SkyBridge On Avalanche 🤯

Add another tally mark to Avalanche’s already stupidly large win category: SkyBridge Capital just moved $300 million of its hedge funds on-chain with Tokeny and Apex Group. 💥

The Digital Macro Master Fund and Legion Strategies Fund are the first guinea pigs. Tokeny - scooped up by Apex earlier this year - is doing the heavy lifting. Apex itself sits on $3.5 trillion in serviced assets, so this isn’t some garage DAO experiment.

Anthony Scaramucci, still equal parts hedge funder and hype man, framed it as transparency, liquidity, and access for allocators that usually need an invite and a cigar to get in.

TL;DR: the Mooch wants pensions and sovereign wealth to dip a toe without worrying about custody or compliance gremlins.

Avalanche was the chain of choice because it clears near instantly and already hosts tokenized money markets and private credit. John Wu at Ava Labs called this a “market signal” that institutional tokenization is finally mainstream. I don’t know about ‘mainstream’ yet for TradFi, hedge fund, or VC money - but it’s getting close. 🤌

TECHNICAL ANALYSIS

BTC Continuing To Lose Ground To The Rest Of The Crypto Market 📉

Just a quick update on the BTC Dominance chart. 💹

Back in Nov 21 - Dec 3, 2024, BTC’s dominance tanked 6.97 points (-11.32%) in just 12 days. That dump was the biggest since the current trend higher occurred over three years ago.

The current leg lower started back on June 27, 2025, has stretched 51 days so far, peeling off 6.84 points (-10.36%).

So what does that tell us?

The market’s bleeding dominance at a slower, steadier pace this round. This 2025 slide looks more like a controlled rotation into alts.

A few more red days and this current swing will likely meet and exceed the drop that happened in Nov-Dec 2024. 🧠

SPONSORED

Bitcoin Depot: The Crypto Stock Backed by Real Growth

Bitcoin Depot (Nasdaq: BTM) isn't just riding the crypto wave; it’s building the very foundation of mainstream adoption. As the world's largest Bitcoin ATM operator, their Q2 2025 financials prove it:

Revenue up 6% YoY to $172.1M

Net income up 183% YoY to $12.3M

Adjusted EBITDA up 46% YoY to $18.5M

This robust profitability is driven historically by ATM usage, not Bitcoin’s price swings. With nearly $60M in cash and digital assets, including a growing Bitcoin treasury, they’re ready to capitalize on growth opportunities both in the U.S. and internationally.

The above is for general informational purposes only and is not investment advice nor does it constitute an offer, recommendation, or solicitation to buy or sell a particular financial instrument. Bitcoin Depot is not a registered investment adviser under the U.S. Investment Advisers Act of 1940. Nothing contained herein constitutes a solicitation, recommendation, endorsement, or offer by Bitcoin Depot to buy or sell any securities or other financial instruments.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

DEFI

The $50K Trade That Dodged Fees, Attacks, and Still Tripled 😱

Everyday, I go through roughly 200+ individual crypto/token pages (official blogs, X accounts, etc) to keep Litepaper readers updated to what’s going on out there besides the various tropey headline versions of ‘ABC Crashes x%, Here’s Where This Analyst Says It’s Going Next’ 😐️

Every once and while, there’s a cool/interesting story that’s worth getting a bigger look at - and this one is from Bancor.

Well Done $BNT.X ( ▼ 1.02% ), Well Done

April 7, 2025. ETH at $1,600. A trader sits on $50,000 and two paths: the “industry standard” AMM (Automated Market Maker) swap, or Carbon DeFi’s limit order rails.

The trader picked Carbon. Good choice.

On another AMM, that $50k trade would have leaked hundreds instantly - 0.01% to 1% swap fees, another 0.25% tacked on by the UI, plus the silent tax of slippage.

Add in a sandwich attack (the Bancor article cited Ethereum had 2,911 of those in just 24 hours, costing traders $20k in stolen value), and the pain compounds.

Hold Up ✋

I did some looking into the numbers and costs of sandwich attacks using Grok 4, ChatGPT 5 Pro, Claude 4.1, and Gemini 2.5 - and without getting into the nitty gritty of each, the consensus amongst all four models was:

From August 18 to August 20, there have been,

8,351-ish MEV sandwich attacks on ETH for a total of $29,000 (which seems very low to me)

9,000-ish MEV sandwich attacks on SOL for a total of $222,400 (seems low to me)

Back to the story. ⤵️

Instead of using another DEX, this trader placed a limit buy at $1,604.05 and watched Carbon’s solver scan the entire Ethereum network for the best liquidity. Within 3 minutes, the order filled in three clean parts:

25.17 ETH for $40,385.70

5.3647 ETH for $8,605.34

0.629 ETH for $1,008.94

No leakage. No tricks.

Fast forward - that ETH now sits worth about $130k. The trader already flipped the buy into a sell order at $5,585, which would cash out at $174k without even watching charts.

If they had stuck with another DEXs AMM, the entry and exit fees alone would’ve burned thousands because almost all AMMs force trades into one pool, charge fees and leave people open to MEV bot attacks.

Carbon DeFi’s AMM, on the other hand, let’s traders use a true limit order and scans a metric crap ton of pools and order books to fill. No fees, no slippage, no asshole bots front-running you.

The cool part: Carbon’s parent, Bancor, invented the AMM model that saved this trader’s principle and gains.

Well done Bancor, well done. 👏

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

📡 Centralized vs Decentralized AI Data Feeds - Who Do You Trust?

Most AI agents still lean on Infura, Alchemy, or QuickNode, which is basically asking Jeff Bezos’ ghost to babysit your mempool queries. Pocket Network and its “Shannon-era” mesh flip that into a staked, multi-node relay where every call is auditable, permissionless, and censorship-proof. You trade a little latency for resilience, but at least no one can yank your API key mid-trade because they didn’t like your bot. Pocket Network.

🤖 0xLazAI Pushes Digital Twin Kit For Twitter Automation

A Node.js backend with cron jobs and API hooks now lets you schedule, fork, and auto-post tweets like you’re running a bot farm. It’s modular, extendable, and logs every move, which makes it perfect for “AI personas” or just lazy brands that want engagement without effort. Web2 spam, but open-source and self-hosted. Metis.

NEWS IN THREE SENTENCES

Real World Asset Tokenization (RWA) News 🪙

📈 xStocks Bring Wall Street To Solana

Oh look, another fun thing that we in the US can’t play with. Backed mints SPL versions of stocks like AAPL and TSLA with 1:1 custody, and within six weeks volumes hit $2.1B across CEXs and DeFi. Fractional shares, instant settlement, and collateralization mean you can buy $50 of AAPLx and lever it into a Raydium pool before TradFi even clears yesterday’s trades. Solana.

📚 Sage Wants To Tokenize The $580B Education Industry With Adaptive Courses

Your sourdough class could bankroll physics curriculum. Anyone can create interactive classes that fork, evolve, and revenue-share with learners who spin off variants. It’s “learn to earn” meets Udemy with token incentives strapped on. Virtuals Protocol.

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

🪪 IOTA Hierarchies Alpha Drops, Tries To Formalize Trust Without Middlemen

The open-source library lets orgs, people, and devices delegate authority in cryptographically auditable chains. Think universities issuing verifiable diplomas, or supply chains certifying goods with no room for fudged paperwork. Trust becomes programmable, revocable, and not just “because we said so.” IOTA.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending Protocol News 🏦

💥 Binance Pumps Collateral Ratios, Traders Get More Juice

More leverage for degens, more headaches for risk managers? Portfolio Margin assets like A, TON, and ETHFI now carry 65% collateral value instead of 35%. That doubles usable margin, widens liquidation buffers, and makes portfolio juggling easier without extra cash. Vaulta.

NEWS IN THREE SENTENCES

Protocol News 🏦

🧾 Akash Ships Earnings API

The new API finally lets GPU providers pull daily, weekly, and monthly revenue data straight from chain-backed records. Keys can be spun up or revoked, and the docs show how to plug it into dashboards so operators stop living in spreadsheets. Now you’ll know exactly where the money’s bleeding. Akash Network.

🗳️ VeChain Cleans Up Governance Spam With VeBetter DAO Update

New rules now require a Moon-level GM NFT to submit proposals, plus mandatory change logs and caps on whale influence. Supporters no longer lose weekly rewards just for backing a proposal, which should keep smaller holders engaged. Less garbage in the pipeline. VeChain.

LINKS

Links That Don’t Suck 🔗

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Email me (Jonathan Morgan) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of crypto enthusiasts? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in ADA, IMX, COPI, MIN, AGIX, ALGO, ZEC, XLM, and NEAR. 📋