- The Litepaper by Stocktwits

- Posts

- BTC Lost Aggro - Dominance Hits 3 Year Low 🥳

BTC Lost Aggro - Dominance Hits 3 Year Low 🥳

Altcoins absolutely ripping harder and higher

OVERVIEW

BTC Lost Aggro - Dominance Hits 3 Year Low 🥳

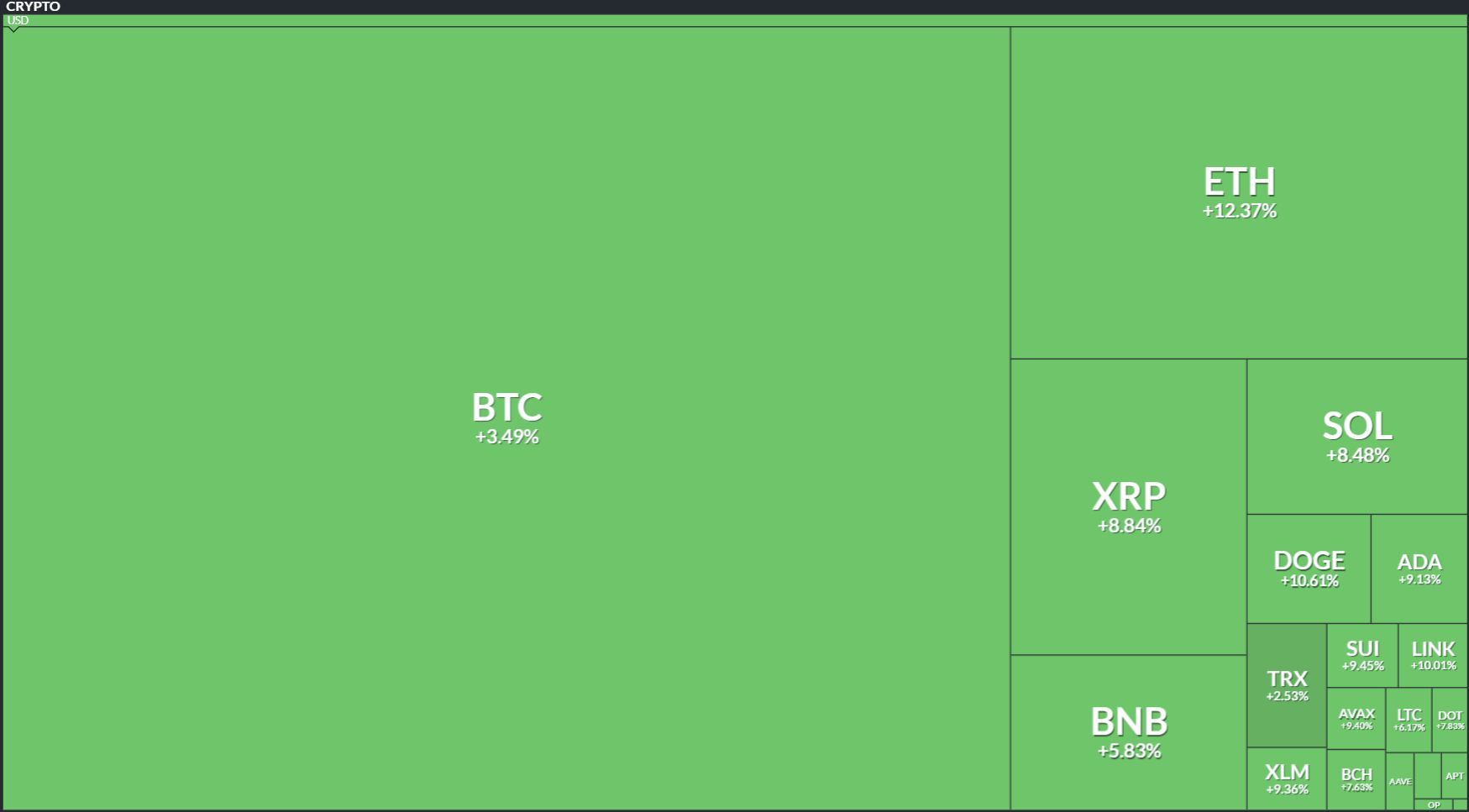

Before we dive in, here’s today’s crypto market heatmap:

And here’s a look at crypto’s total market and altcoin market cap charts:

TECHNICAL ANALYSIS

BTC Dominance Just Printed A 3-Year Worst

It’s official as of this afternoon: the current swing lower for BTC’s dominance chart is nowt the largest swing lower in three years. 📆

The -7.62 point (-11.54% drop) now exceeds the Nov 21 - Dec 3, 2024 6.97 point drop.

Do I want to scream LET’S GO ALTSEASON!!! Yes. But there’s basically 1/3rd of this pita of a month left and if history has taught me anything it’s that it will bite you in the ass.

So, I play the Minnesota Vikings style of how to treat this, be a realistic pessimist. Which means you’re happy but waiting for something bad to happen because you know that good feeling you have isn’t meant for you and it never lasts. 🏈

SPONSORED

Grow your wealth with daily earnings.

Nexo’s Flexible Savings lets you grow your digital assets while keeping them available to use, access, or move at any time.

Why choose Nexo’s Flexible Savings:

Earn up to 14% annual interest, paid daily

Access competitive yields on BTC, ETH, USDC, and more

Withdraw anytime, no penalties or lockups

Keep earning while you hold, rebalance, or trade

Since 2019, Nexo has paid over $1 billion in interest, helping clients build crypto wealth with confidence.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Disclaimer: Nexo services are currently unavailable in the US.

TECHNICAL ANALYSIS

Will It, Won’t It? ETH Soooo Close 😰

It’s 1500 EST and like many in crypto today, I’m waiting for Ethereum to make a new all-time high for the first time in nearly four years. 😱

At the time of writing, the current intraday high is $4,851.50. Which is exactly $17.91 (-0.39%) below the ATH of $4,869.

Keep your eyes open. 👀

NFTs

Dead Pixels Powers Past Punks & Penguins 👻

CryptoPunks and Pudgy Penguins are two NFT names that pretty much dominate the NFT space and trading volume. So when something outperforms them, it’s kind of a big deal. 🎭️

Babe wake up, @deadpixels_club just surpassed @pudgypenguins and CryptoPunks V1 in 24h volume 👻

— Hedera Foundation (@HederaFndn)

2:59 PM • Aug 22, 2025

Kind of a bigger deal when it’s an Hedera-native collection. The Dead Pixel Ghost Club volume is 40% greater than Pudgy Penguins and 23% higher than CryptoPunks.

Also, Dead Pixel Ghost Club has this fancy shmancy Forever Mint attribute to it’s collection.

Forever Mint in a nutshell:

Mint never ends without printing new NFTs.

Every mint triggers two trades: your purchase and the project’s restock buy.

Primary demand becomes programmed bid support on secondary. Floor gets a built-in spotter.

Keeps the “open a pack, get a surprise” loop alive indefinitely, which pulls in people who avoid scrolling secondary.

Plus, it’s always nice to see an art-first NFT take the lead. 👍️

NEWS

DOJ To Crypto: We Prosecute Crimes, Not Code. ✅

Acting AAG Matthew R. Galeotti used his Jackson Hole stage to draw a bright line: prosecutors chase fraud, laundering, and sanctions evasion, not open-source devs shipping non-custodial code. 🎯

Clean sentence. Clear target. About time.

TL;DR

DOJ reaffirms it’s prosecutors, not a shadow regulator. Laws, not vibes.

Writing and publishing code without criminal intent doesn’t make you a felon.

Yes, This Is About Tornado Cash

Acting AAG Galeotti didn’t need to say ‘what’ he’s talking about - it’s a given. The subtext screamed it. The Tornado Cash shite sits at ground zero for the “code vs conduct” fight. And the founders have been the main targets:

Roman Semenov - At large. The FBI has him on a wanted page with ties to Turkey, Dubai, and Moscow. He also remains personally sanctioned after OFAC delisted Tornado Cash’s addresses in March. Individuals didn’t get the same mercy.

Alexey Pertsev - In the Netherlands on conditional release with electronic monitoring while appealing his 64-month sentence. Out of prison, not out of the woods.

Roman Storm - In the U.S., free on a multi-million dollar bond pending sentencing after an Aug 6 jury convicted him on conspiracy to operate an unlicensed money transmitting business. Jury deadlocked on the other counts, which the court marked as a partial mistrial.

For now, the DOJ just said code without crime isn’t the crime. Keep it non-custodial, keep it neutral, keep it clean, and go ship.

Or, if you do code your own blockchain/token/protocol/network, just do what Satoshi did: don’t tell anyone who you are. 🧠

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

🎮 Zealy + Kava Want You To Play Your Way Into DeFAI

Zealy’s gamified quests are being strapped onto Kava’s decentralized AI stack to onboard humans, not just GPUs. Instead of “click button, get token,” quests could mean training models, testing DePIN hardware, or voting on governance - all while stacking rewards. It’s basically Pokémon GO for decentralized AI: do tasks in the wild, earn loot, level up the network. Kava.

🕵️ Zano Expands Privacy Tools, Fights Off Spy Nodes

Zano’s quietly hardening its privacy fortress (I mean, except for the part they post about it) while building grassroots momentum. The privacy chain rolled out blacklist configs to block suspicious peers, added cold-signing fixes, and upgraded mobile wallets with Obscura NFTs and POS QR codes. Zano.

NEWS IN THREE SENTENCES

Real World Asset Tokenization (RWA) News 🪙

🏦 Centrifuge Launches deRWA Tokens Across EVM

Wall Street-grade debt dressed up like an ERC-20 so you can finally farm yield with corporate paper. Centrifuge just put tokenized real-world assets where DeFi lives: Aerodrome for trading, Coinbase and OKX wallets for access, and Morpho for lending. First up is deJAAA, a transferable slice of a AAA-rated credit fund you can now hold, trade, or collateralize. Centrifuge.

📚 Story Preps Chapter 2: Programmable IP For The AI Era

Since launching its L1 in February, Story has delivered attestation services, IP portals, and seamless uptime. Next, it wants to turn IP into programmable assets with “IP Vaults” that let creators attach rights-cleared data and license it on-chain. It’s like a blockchain app store - but instead of selling widgets, you’re trading verified intellectual property for AI to tap into. Story.

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

🤝 UXLINK Bets Big On SocialFi, 54M Users And Counting

With DeFi slipping under 20% of gas usage, UXLINK’s Telegram-powered social graph is making Web3 feel more like Web2, only with wallets. Users own their IDs, build verifiable two-way connections, and tap AI-powered networking to find projects, payments, and perks. If Facebook made you the product, UXLINK’s pitch is: this time you keep the receipts. UXLINK.

🎥 ASI Alliance Turns Crypto Stack Into Reality TV

Two contestants start with $100 and no plan, racing across Europe powered only by ASI’s AI agents. Each episode drops a seed phrase Easter egg while viewers watch them fumble through language barriers, roulette-wheel challenges, and questionable wildlife encounters. It’s part treasure hunt, part product demo - Survivor meets Web3 shill. Artificial Superintelligence Alliance.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending News 🏦

👻 Aave Jumps To Aptos, First Non-EVM Chain Deployment

This is the crypto equivalent of Starbucks opening its first store in a new country. Aave V3 has been retooled in the Move language and launched on Aptos with USDC, USDT, APT, and sUSDe lending markets. It’s a first for Aave outside Ethereum land, and Aptos gets instant legitimacy with DeFi’s biggest liquidity engine plugged in. Aptos.

NEWS IN THREE SENTENCES

Protocol News 🏦

⚙️ Arbitrum Wants Gas Fees To Finally Make Sense

Right now, every transaction on Arbitrum gets priced like it’s using the same resources, whether it’s just adding two numbers or dumping megabytes of state data. Dynamic Pricing splits gas into five buckets - compute, state access, state growth, history growth, and calldata - so you actually pay for what you use. Think of it like a utility bill: you don’t get charged water rates for running the toaster, so why should a storage-heavy contract cost the same as a quick ADD? Arbitrum.

🪙 Flare’s FXRP v1.2 Hits Songbird, Security First

FXRP’s upgrade comes with cleaner code, bug bounties, a Zellic audit, and now a Code4rena competition poking at it live. XRP collateral is locked, wrapped, and minted trustlessly onto Flare’s EVM playground, bringing it straight into DeFi. Think of it as giving XRP a passport to cross into Ethereum country without handing it to shady border guards. Flare Network.

LINKS

Links That Don’t Suck 🔗

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Email me (Jonathan Morgan) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of crypto enthusiasts? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in ADA, IMX, COPI, MIN, AGIX, ALGO, ZEC, XLM, and NEAR. 📋