- The Litepaper by Stocktwits

- Posts

- Crypto Rally Stubs Toe, Face Plants, And Waits To Get Up 🤕

Crypto Rally Stubs Toe, Face Plants, And Waits To Get Up 🤕

When crypto pulls back, it does it hard

OVERVIEW

Crypto Rally Stubs Toe, Face Plants, And Waits To Get Up 🤕

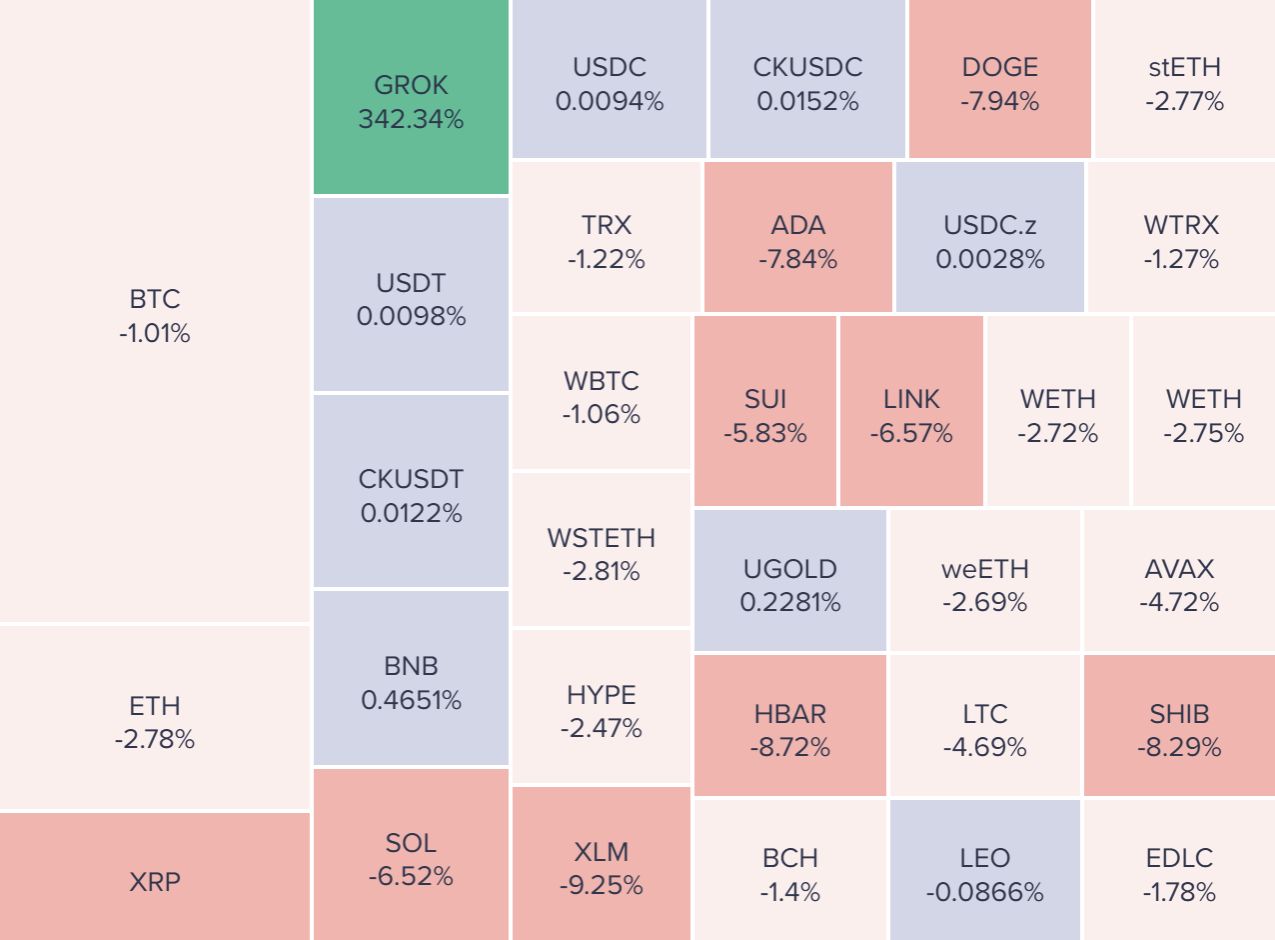

Before we dive in, here’s today’s crypto market heatmap:

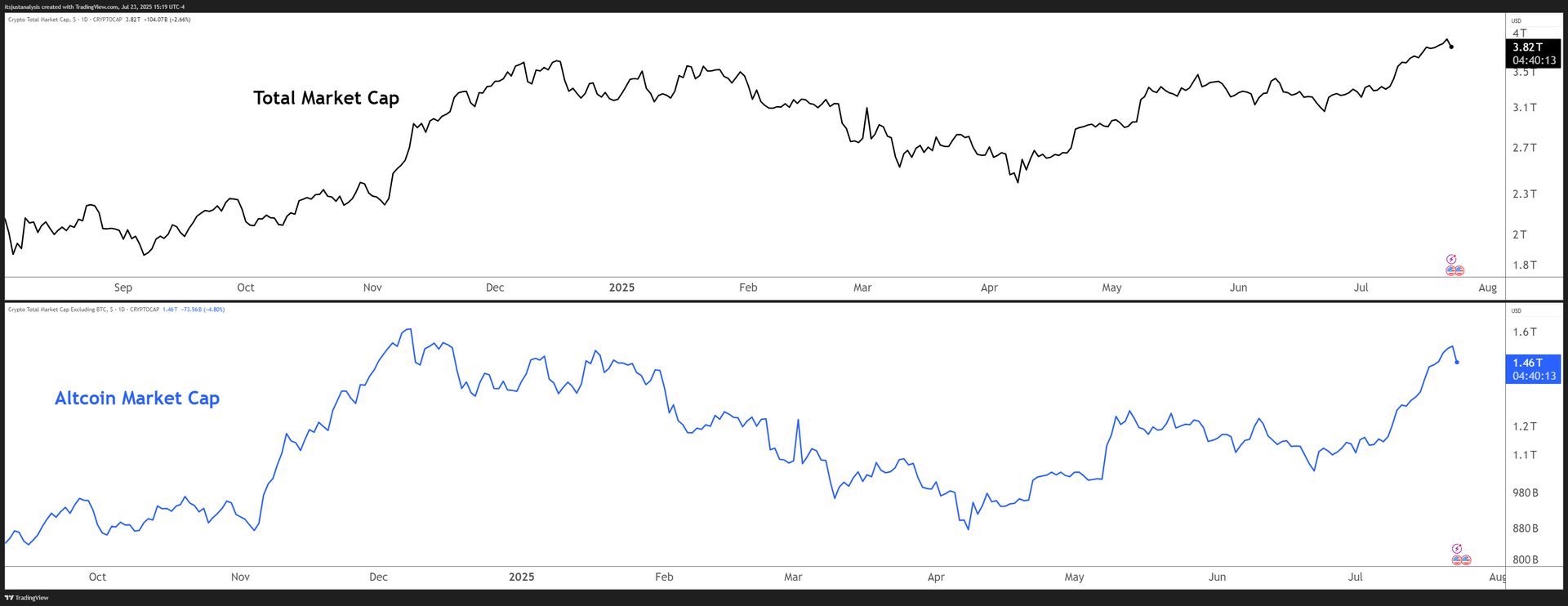

And here’s a look at crypto’s total market and altcoin market cap charts:

NEWS

BNY & Goldman Turn Money‑Market Cash Into Blockchain Chow 🏦

BNY & Goldman are tokenizing old‑school money‑market funds and calling it progress. 😎

BNY’s LiquidityDirect pipes now talk to Goldman’s GS DAP, so fund subscriptions and redemptions settle on‑chain instead of wheezing through overnight batch files.

Mirror tokens track every share you hold, letting desks shove MMF stakes around as instant collateral rather than waiting for dusty DTCC receipts.

BlackRock, Dreyfus, Federated Hermes, Fidelity, and Goldman’s own asset arm are first through the door. If that lineup doesn’t scream “TradFi FOMO,” nothing will.

Nice Things Come In Pairs 🤔

Liquidity management: Tokenized MMF shares can hop wallets 24/7, slashing margin calls from hours to seconds. That’s not sexy, but freed‑up cash sure is.

Compliance brownie points: The tokens mirror, not replace, BNY’s official ledger, so auditors keep their spreadsheets and everyone stays friends with the SEC.

If wall‑street grandpas feel safe wrapping trillions in blockchain bubble wrap, every other asset class is next: bonds, repos, baseball cards, who knows. 👋

NEWS

Solana RICO‑Slapped: Yakovenko, Jito Crew Dragged Into Pump.fun Circus 🎪

Lawyers just tossed half of Solana’s C‑suite into a racketeering blender and hit purée. 😱

Burwick Law and Wolf Popper tacked Solana Foundation, Solana Labs, Jito Labs, plus execs Anatoly Yakovenko, Raj Gokal, Dan Albert, Lily Liu, Austin Federa, Lucas Bruder, and Brian Smith onto their Pump.fun lawsuit.

Fresh filing lobs RICO counts built on illegal gambling, wire fraud, IP theft, securities fraud, and unlicensed money‑transmitting.

Plaintiffs say Pump ignored AML rules so completely that North Korea’s Lazarus Group strolled in, launched “QinShihuang,” and washed Bybit‑hack loot through Solana like a free hotel laundry.

Suit pegs Pump’s “digital casino” haul at $722.85M, accusing Jito of auctioning off “winning spins” to the highest briber while validators whistled.

We’ll keep you updated as this story develops. 📰

NEWS

MARA Slings $850M Zero‑Coupon Moon Ticket

MARA’s pitching a no‑interest convertible so it can stack more sats and roll old debt. 🗞️

$850M in 0.00% convertible notes due 2032, Rule 144A only to the big‑kid money.

Bankers get a $150M greenshoe if demand goes full degen.

Cash/stock conversion switch hits, plus a holder put on Jan 4, 2030 and company call after Jan 15, 2030.

Up to $50M of proceeds will yank a slice of MARA’s 1% 2026 converts, the rest funds capped calls, fresh Bitcoin, and “general corporate” - translation: more miners, more hash.

Shares sagged 4.5% on the news, proving markets hate zero coupons unless they’re called T‑bills.

Ouch? 🤕

Dilution dampener: Capped calls mean fewer new shares if the convert rips in‑the‑money.

Balance‑sheet yoga: Swapping 2026 paper for 2032 paper plus BTC leaves creditors chasing an 8‑year treadmill.

Signal check: Zero coupon says MARA thinks its stock runs hotter than any interest rate the Fed can imagine.

Borrowing free money to buy volatile money is peak 2025 energy. If Bitcoin moons, MARA looks like a genius. If it face‑plants, bondholders own an ASIC farm and a couple of Florida billboards. 🖼️

NEWS

Sonic’s $190M Token Blast Leaves Only 12k Wallets Cheering 😥

Sonic Labs carved Season 1 into two reward buckets - Points and Gems - and swore it would be “fair.” Reality says otherwise. 😠

The numbers:

Tokens on the table: 80.8M $S (49M already siphoned through Points, another 30M dangling as Gems)

Claim mechanics: 25% liquid on the spot, 75% locked for 270 days inside tradable NFTs

Progress so far: 26.9M $S claimed across 5,534 wallets; single best haul hit 742,675 $S

Points farming rolls on: vault loops on Aave or Pendle grind up to 8x multipliers and 30% APY, while creator programs drip more $S back to loud supporters. Sonic Labs even torched 1.87M $S from its own stash to prove “merit‑based” love. Nice gesture, though it barely dented the salt.

Price Dumps, Rage Tweets 😡

Backlash? Loud. Long‑time degens with four‑digit transaction counts got zilch because their balances fell under the “dust” line.

One top‑heavy wallet yanked 750k $S, market‑dumped on Binance, and fled.

The $S @SonicLabs airdrop was not designed for farmers.

While the top wallet that claimed 750K $S, just liquidated all his liquid $S on Binance!

& completely exited Sonic Ecosystem! (Not farming S2 any more)

Net worth: 131M

Source:

— DoctorDeFi (@DoctorDeFi)

4:14 PM • Jul 23, 2025

Price slumped, TVL bled from ecosystem dApps, and more traders bragged about shorting $S than farming it.

No official word yet about what’s going on, but we’ll keep you updated if that changes. 👍️

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

🤖 Sensay Plugs Into ASI Alliance So Its Chatbots Can Finally Pass the Eye-Roll Test

Great,now your sales funnel can judge you smarter than your manager and still invoice on-chain. Integrating ASI:One models hands Sensay bots more autonomy for lead-qualifying and support gigs. The tie-up links Sensay with Fetch.ai, SingularityNET, Ocean, and CUDOS, paving paths to AgentVerse workflows and DAO agents. Artificial Superintelligence Alliance.

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

🏆 Axie Merges Its Bounty Boards Because Two Battlepasses Were One Too Many

Phase 1 shifts loot toward the premium board, scraps Captchas, and rewires twenty quests to kill duplicates. The endgame is a unified Battlepass-style system that scales progression and AXS payouts with player loyalty. Translation: mercenaries get crumbs while devoted Lunacians grind harder for digital pet rent. Axie Infinity.

🧌 Gala Swaps Your Retired VEXI Trolls for Shiny New Toys and Calls It Progress

Nothing says evolution like yanking NFTs from gameplay and mailing you consolation loot you didn’t ask for. Holders will auto-receive a rarity-matched VEXI character plus a themed building, with extra perks for ultra-rare trolls. The originals stay frozen on-chain for nostalgia and speculative trading. Gala Games.

🕹️ Decentraland Has More Than Dance Floors – Try Not to Get Lost

MANA’s latest guide highlights ten off-event activities, from wearable-grinding mini-games to rolling your own world in Creator Hub. Adventurers who think Decentraland sleeps after a headline concert will discover 90,000 parcels ready to roast that idea. Daily quests, parkour rooftops, chess boards, and Art-filter hunts mean you’ll stumble from neon storefront to hidden temple faster than the map can load. Decentraland.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending Protocol News 🏦

⚙️ Core’s Satoshi Plus Lets You Stake BTC, Hashpower, and Ego All at Once

Validators rack up hybrid scores by combining delegated Bitcoin hashpower, time-locked BTC, and staked CORE tokens. Why choose between proof-of-work bragging rights and proof-of-stake yield when you can juggle both and risk slashing on two fronts. Every epoch crowns 31 operators, handing them 90% of emissions while jail time awaits the slackers. CoreDAO.

🪙 IO Wants Bitcoin to Run Cardano-Style Contracts Without Breaking a Sweat

Maxis might clutch their ASICs, but a RISC-V pipeline is sneaking Python contracts onto Bitcoin. BitVMX compiles Cardano’s UPLC through a CEK machine into RISC-V, letting optimistic fraud proofs keep BTC untouched unless someone cheats. Demoed at Bitcoin 2025, the stack teases native BTC DeFi and cross-chain bridges without opcode surgery - unlike the text in this summary which sounds like opcode surgery. Cardano.

LINKS

Links That Don’t Suck 🔗

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Email me (Jonathan Morgan) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of crypto enthusiasts? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in ADA, IMX, COPI, MIN, AGIX, ALGO, ZEC, XLM, and NEAR. 📋