- The Litepaper by Stocktwits

- Posts

- Fed Verbs Don’t Trade Charts 📊

Fed Verbs Don’t Trade Charts 📊

Hike, cut, whatever. The phase is the boss. Next week, the shenanigans begin.

OVERVIEW

Fed Verbs Don’t Trade Charts 📊

Before we dive in, here’s today’s crypto market heatmap:

Source: Santiment

And here’s a look at crypto’s total market and altcoin market cap charts:

TECHNICAL ANALYSIS

When The Fed Cuts/Raises Rates, How Has ETH Responded?

In past Litepapers, I’ve focused mainly on how Bitcoin has moved after major economic announcements/events. Today we’re going to look at how ETH has moved because it’s the biggest altcoin out there (probably not even considered an altcoin anymore). 🧠

So, how ETH moves is most likely how the rest of the altcoin market will move.

Date range: December 15, 2016 – December 19, 2024

Events analyzed: 27 total (19 hikes, 8 cuts)

The Verb (Hike vs Cut) Doesn’t Carry The Edge. The Path Does.

Hikes: median 7-day -2.9%, median 30-day +0.8%. First week weak, next three weeks grind back.

Cuts: median 7-day +2.1%, median 30-day -10%. Relief pop, then sag.

52% of events had the 7-day move and the 7 to 30 drift pointing opposite ways.

In other words, the first week is often noise.

Trend Phase Is The Boss

At the time of a rate decision date, it matters where ETH is relation to its 200-day MA:

Below 200-day: 30-day median +7.3%.

Above 200-day: 30-day median -3.9%.

Same pattern with the 50-day: below = better forward returns, above = disappointment.

Phase mattered more than the hike/cut label.

ETH Above Or Below The 200-Day MA

Action | ETH 200-day MA Location | 7-day | 30-day |

|---|---|---|---|

Cut | Below 200-day | +6.8% | +7.4% |

Cut | Above 200-day | -2.4% | -20.7% |

Hike | Below 200-day | -2.8% | +3.2% |

Hike | Above 200-day | -4.3% | +0.8% |

Cuts in uptrends were traps. Cuts in downtrends had juice. Hikes in downtrends gave mean-reversion longs.

What Will Traders Do After A Hike?

If ETH is below the 200-day: they probably won’t want to chase the knee-jerk drop.

If above the 200-day: tempting, but they’ll likely skip the hero trade.

What Will Traders Do After A Cut?

If above the 200-day: smart traders won’t chase the pump.

If below the 200-day: ride the 1-week relief leg. 🦵

ON-CHAIN ANALYSIS

Spent Output Profit Ratio Check-up ➿

It’s been a while since we’ve looked at the SOPR levels - so let’s look at some of them now. 👀

SOPR (Spent Output Profit Ratio) tells us whether coins moving on-chain are being sold at a profit (>1) or at a loss (<1). Sustained moves above or below 1 help clue us in on trend health.

Bitcoin $BTC.X ( ▲ 0.73% )

SOPR mostly hugging 1 with occasional spikes.

The spikes are noise; the base line says most BTC is being transacted near break-even.

That’s neither euphoric nor panicked - basically neutral.

Nobody’s eager to dump into strength, but also not capitulating.

Read: Neutral

Ethereum $ETH.X ( ▲ 2.01% )

SOPR sits consistently above 1 through most of July and August, even while price trended up.

High-frequency oscillations show traders scalping, but the mean stayed profit-positive.

That’s strength - holders are booking profits without derailing the uptrend.

Stronger than BTC here.

Read: Bullish

Solana $SOL.X ( ▲ 1.67% )

SOPR whipsaws hard around 1 but the September move is clearly trending higher with price.

Lately, it’s lifted clean above 1, meaning profit-taking is happening while price climbs - buyers are absorbing supply.

That’s the classic “healthy profit-taking in a trend” setup.

Read: Bullish

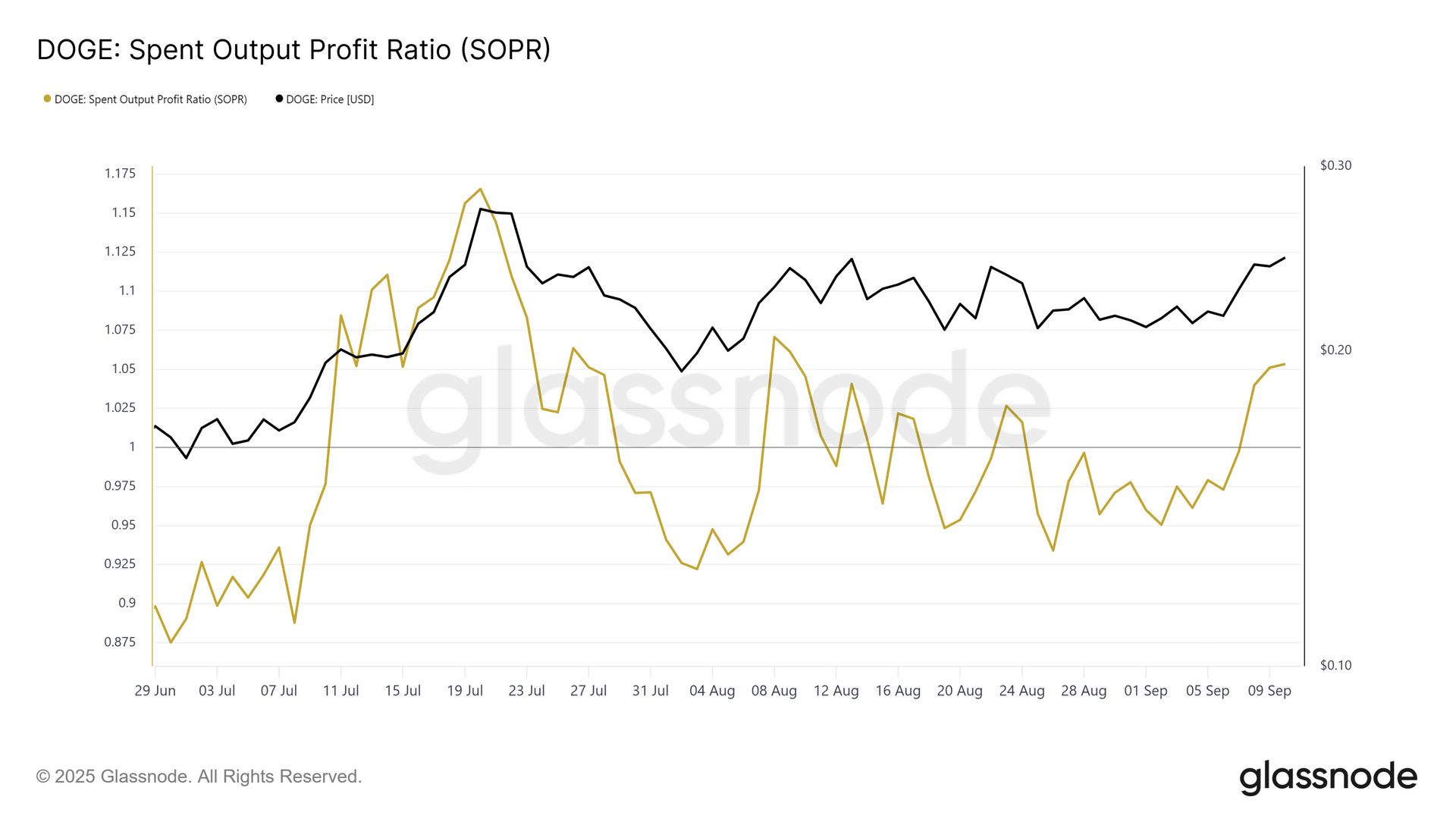

Dogecoin $DOGE.X ( ▲ 3.68% )

July saw SOPR spike way above 1, then crater under it for weeks while price stayed soft.

Recently, SOPR has clawed back above 1 in sync with price rising.

That flip is meaningful - loss sellers are gone, profit-taking is back.

Still volatile, but the worst looks behind it.

Read: Bullish tilt, but with volatility risk

TL;DR

BTC: Neutral, trend undecided.

ETH: Bullish, steady profit-taking without breaking momentum.

SOL: Bullish, profit absorption points to trend continuation.

DOGE: Bullish tilt, though still prone to whipsaws.

In other words, BTC’s the grumpy uncle sitting out, while ETH, SOL, and even DOGE are out back revving their engines. 🚦

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

🔒 SKALE’s FAIR Whitepaper: Encryption At Consensus

Proof of Encryption (PoE) now bakes transaction privacy directly into SKALE consensus using BITE protocol. That kills MEV, seals DeFi strategies until execution, and finally makes blockchains institution-safe. Like sending a sealed envelope to the post office instead of letting the clerk read your letter first. SKALE Network.

NEWS IN THREE SENTENCES

Real World Asset Tokenization (RWA) News 🪙

🌍 IOTA + Salus: Tokenizing Trade Finance For Critical Minerals

This is essentially DHL tracking meets on-chain collateral - except the stakes are $2.5T in global trade. IOTA’s TWIN stack is now powering Salus, a platform digitizing supply chains for copper, lithium, and rare earths. NFTs replace bills of lading, DIDs handle compliance, and smart contracts auto-release payments when shipments clear inspection. IOTA.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending News 🏦

📊 Backpack Exchange Brings Pro Trading To Aptos

Backpack rolled out on Aptos with spot, perps, lending, fiat ramps, and daily proof of reserves. Traders get cross-margin, yield-bearing collateral, and 1:1 USD on/off ramps, audited by OtterSec. Aptos.

🏦 Archax Launches Pool Tokens On Hedera, TradFi Gets Composable

Archax just dropped Pool Tokens on Hedera, starting with a “fund of funds” holding slices of BlackRock, State Street, Aberdeen, and Legal & General. No prospectus, no 3-week settlement lag - it’s basically mutual funds turned into Lego bricks you can swap instantly. TradFi finally learned what DeFi kids figured out years ago: copy-paste liquidity beats paperwork. Hedera.

⛓️ Chainlink Data Streams Go Live On Sei, Now With Gov Data

Chainlink’s low-latency oracles are integrated with Sei, pumping sub-second market feeds plus U.S. economic stats straight on-chain. Real GDP, PCE, and liquidity-weighted spreads all now live inside Sei’s trading stack. It’s Bloomberg terminals meets smart contracts - and yes, the feds just cosigned it. Sei.

NEWS IN THREE SENTENCES

Protocol News 🏦

🥤 ICON Migrates To SODA, Because Branding And Focus Matter

ICX is moving to SODAX (ticker: SODA) with a two-way test migration starting Sept 15. Early adopters can swap 1:1 into the new token and test Sonic chain infra, though staking and liquidity stay on ICX for now. Icon.

🛠️ Stellar Dodges NPM Supply Chain Bullet

A massive NPM attack tried to sneak wallet-hijacking code into billions of downloads, but Stellar’s repos came out clean. SDF pinned safe versions and audited everything, so devs can breathe for now. Reminder: NPM packages are like free candy from strangers - sometimes it’s fine, sometimes it’s laced. Stellar.

🐕 Shiba’s LEASH Migration: New Token, No Mint Shenanigans

LEASH V2 is here: ERC-20, audited, and minted in full so the migrator can’t rug supply. Holders swap 1:1 by ratio, stakers and LPs migrate in phases, and Shibarium users get their own bridge flow. Like trading in your old car for a new model - except the dealer can’t secretly print more vehicles Shiba Inu.

LINKS

Links That Don’t Suck 🔗

Get In Touch 📬

Email me (Jonathan Morgan) your feedback; I’d love to hear from you. 📧

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in ADA, IMX, COPI, MIN, AGIX, ALGO, ZEC, XLM, and NEAR. 📋