- The Litepaper by Stocktwits

- Posts

- Fifty Shades Of Chainsaw: Crypto Bros Swap Dungeon For Ankle Monitors 🚨

Fifty Shades Of Chainsaw: Crypto Bros Swap Dungeon For Ankle Monitors 🚨

I have no words. This is as funny as it is disturbing as it is unsurprising.

OVERVIEW

Fifty Shades Of Chainsaw: Crypto Bros Swap Dungeon For Ankle Monitors 🚨

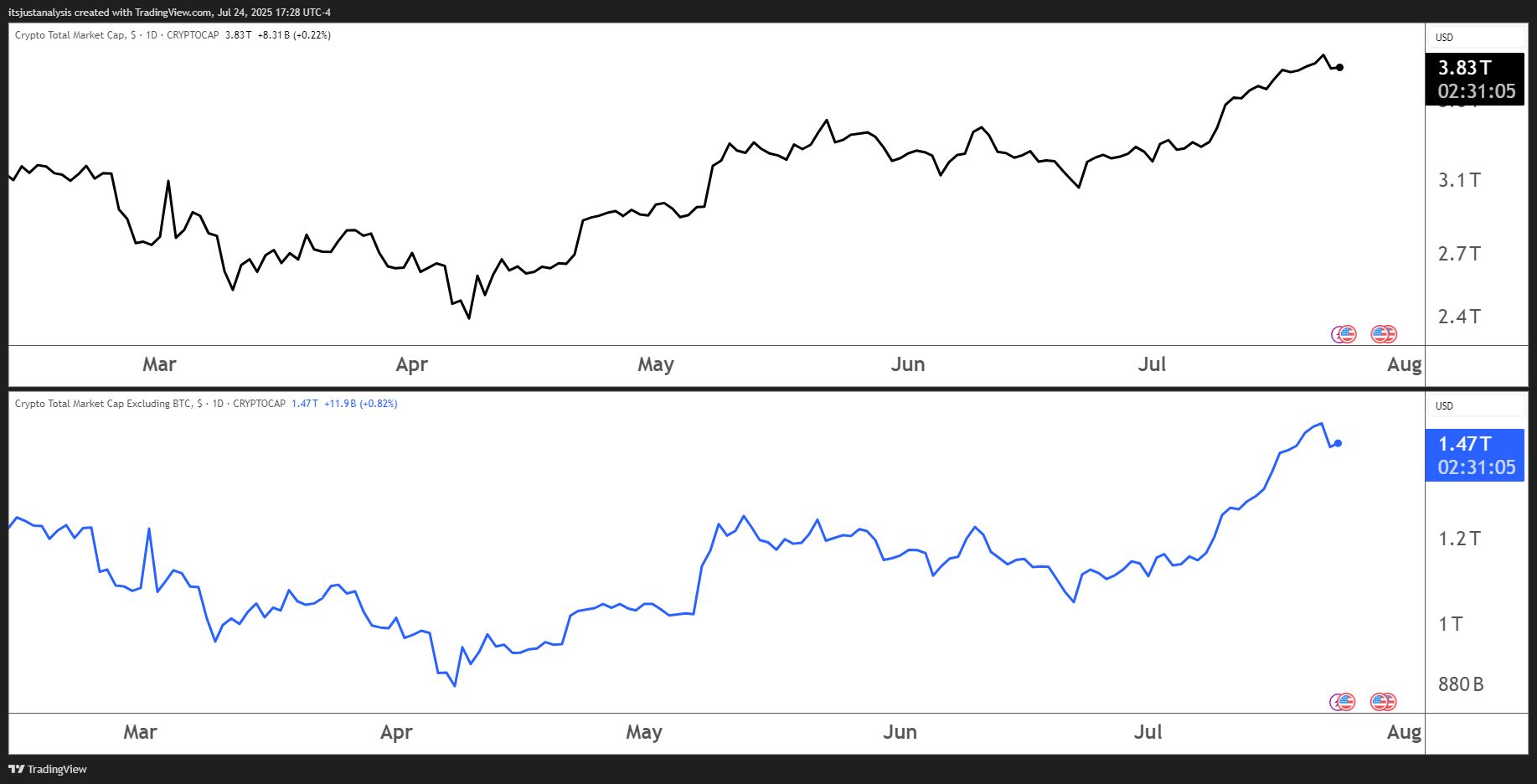

Before we dive in, here’s today’s crypto market heatmap:

Source: Santiment

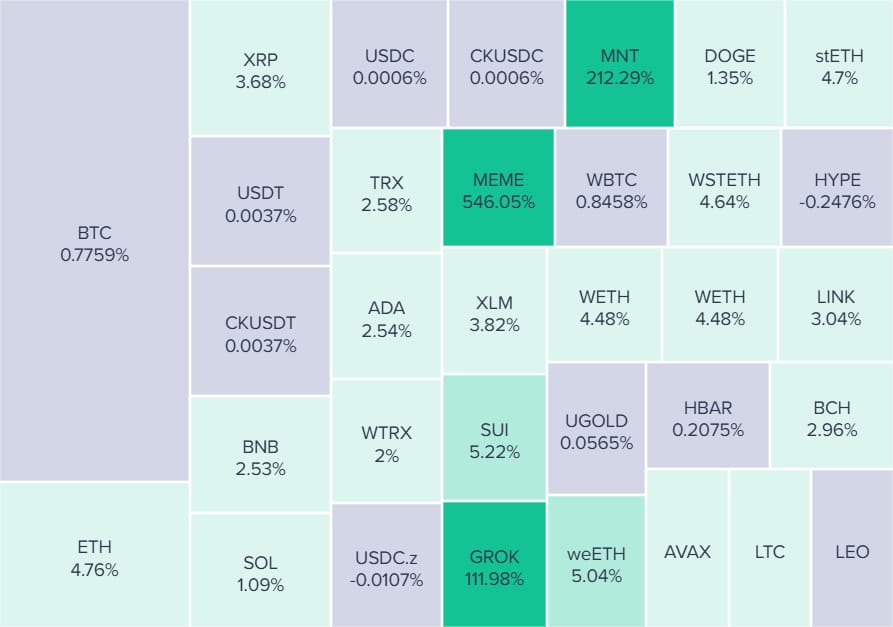

And here’s a look at crypto’s total market and altcoin market cap charts:

NEWS

Kidnap‑Lite: Manhattan’s Crypto Bros Score $1M Get‑Out‑of‑Jail Cards 🤦

I’ve been involved in crypto since 2015-ish and I’ve been at writing The Litepaper here at Stocktwits for three years. I’ve seen, read, experienced, and written about some crazy stuff. 😐️

But this story, dear readers, has to be the stupidest, craziest and most par-for-the-course story in a long while. And it’s a story we last looked at back in the May 27 Litepaper.

What Happened 🤔

Italian trader Michael Carturan, a 28‑year‑old Italian trader chasing crypto deals, landed in Manhattan on May 6 and got the “welcome to America” nightmare package. 😨

Prosecutors say John Woeltz (self‑anointed Kentucky’s crypto king) and William Duplessie (Miami’s favorite trust‑fund party boy) spent 17 days turning a $24M SoHo townhouse into their private horror show.

Highlights: waterboarding in the marble bathroom, pistol‑whipping on Persian rugs, tequila‑and‑firelight foreplay, chainsaw intimidation, and a cattle prod cameo. When flames flickered, the duo allegedly played fire brigade by urinating on their victim.

All in pursuit of one juicy Bitcoin password.

Defense: Bro, It Was Just Hazing Bro 🙄

Defense lawyers swear the whole thing was “frat‑house hazing.” They rolled courtroom footage of the victim smoking crack, joining an orgy, and crawling in a BDSM collar.

That wasn’t torture, it was just, according to the defense, “17 days of shenanigans.” 👨🎓

Prosecution: Um. No. 😶

Prosecutors fired back: victims don’t always scream on cue, especially with a gun to their head and threats to butcher their family. Prosecutor Sarah Khan wanted the pair caged until trial.

She laid out grim receipts:

Pics: Photos of a gun jammed against Carturan’s head (they even made T-shirts!)

Texts: Texts promising to kill his parents.

Medical Reports: Burns, bruises, and ligature marks.

She also dropped the tequila + fire + urine combo on the record, for anyone who still thought “hazing” covered it.

Assistant Cam: Texts show John Woeltz ordering one flunky to “watch the guy” every time the captive touched a phone. Second flunky replies, “Don’t worry I’m watching him,” like this is DoorDash, not felony kidnapping.

Drug Logic: William Duplessie said he and Woeltz had to keep doing drugs because they’d forced the victim to stay high - so solidarity, right?

Broken Toy Brag: Messages boast the Italian trader looked “broken… no more life in his eyes.” That’s the vibe the defense insists was consensual hazing.

What cops hauled out of SoHo Hell:

a loaded Glock

hacksaws

drugs

more drugs

more drugs and pills and drugs

zip ties

a chainsaw

body armor

30 phones

30 crypto hardware wallets

A handwritten “purge foreigners” manifesto detailing how to gain a target’s trust, then “extract” their crypto.

Not Their First Rodeo 🎠

Woeltz and Duplessie have apparently been at these kind of shenanigans before.

Woeltz once held someone hostage in Kentucky for crypto ransom.

Duplessie was probed in Switzerland for domestic violence.

Feds think two more victims exist.

What Did The Judge Do? 😰

Over the DA’s protests, Judge Gregory Carro slapped each man with $1M bail, banned crypto as payment (which they converted into Benjamins and made bail), and handed out ankle monitors.

Duplessie gets beachside confinement in Miami. Woeltz just needs a “court‑approved” couch in New York.

Oh, and because the judge probably confused court mandated sobriety check-ins with felony kidnapping and torture, Woeltz and Duplessie have to phone check in every 72 hours. 📞

Someone call Kalshi and Polymarket because my money is on a Netflix special in a couple years and a Yelp badge for “Best Defense Team in History.”

And if someone wants to talk to you in Soho about crypto, be like Nancy Reagan and Just Say No to SoHo. 🙅

NEWS

$SQ Booted Big Oil 🥳

Wall Street just booted Big Oil and let Jack Dorsey’s Bitcoin piggy bank sneak into the S&P 500. 🥳

Block ($SQ) replaces Hess after Chevron swallowed the driller, jacking up the index’s crypto exposure and making passive‑fund quants scramble for shares.

A Trend? 🤔

Three’s a Trend. Tesla opened the door, Coinbase barged through in May, and now Block rounds out a Bitcoin‑friendly trio inside the benchmark.

Index‑Fund FOMO. JPMorgan pegs forced buying at 54.2 M shares, a tidy flow that should keep $SQ bid as ETFs rebalance.

Crypto on the Cap Table. Block sits on 8,584 BTC ($1.03B at $120K each),

Skin in the Game. Management shovels 10% of gross Bitcoin‑product profit into fresh coins each month; dollar-cost averaging like a true maxi.

Beyond the Treasury 💰️

Cash App already lets 56M users buy sats, Bitkey pushes self‑custody, and Lightning integration is penciled in by 2026-meaning Block is wiring Bitcoin rails straight into Main Street spending.

When the hedge‑fund crowd inevitably apes in, they won’t even notice the shift: exposure comes baked into every vanilla S&P tracker they own.

Big Picture 📺️

Block’s arrival means 10% of the index’s new members this year are outright crypto plays, signing off on the thesis that digital assets aren’t a sideshow. Energy out, entropy in.

Traditional finance just got another involuntary Bitcoin upgrade. 👍️

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

🕵️ Secret Network Brags About TEE Upgrades While Sneaking In SecretAI Bling

Roadmap check-in shows hardened MRENCLAVE, batch token wrapping, and a Cron module grafted onto privacy tech that would melt lesser Cosmos chains. SecretAI and SecretVM now let devs spin confidential workloads and trustless LLMs without sharing their secret sauce. Secret Network.

📷 Brave Blocks Microsoft Recall Because Screenshots of Your Tabs Are Nobody’s Business

Version 1.81 flags every page as private so Windows 11’s controversial timelapse feature records nothing but blank space. Users can flip a toggle if they miss risking intimate browsing in plaintext. Basic Attention Token.

📜 DeXe Says AI Governance Needs Powersharing - And It Already Wrote the Smart Contracts

A new paper urges six tasks from blocking harm to steering public goods, but DeXe brags its modular DAO stack has delegation, meta-governance, and treasury knobs baked in. Negative freedoms, positive freedoms, and on-chain budgets meet Solidity reality. DeXe Network.

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

🏟️ Flamengo and Friends Mint AI-Generated Player Cards on Chiliz - Scarcity Meets Soccer Hype

Your childhood sticker album just got a blockchain sequel you’ll pay gas for. Six Brazilian clubs drop “Cards do Futebol” NFTs with random athlete combos, three rarity tiers, and staking hooks for Fan Token diehards. Only one card per combo exists, so collectors can finally flex that ultra-rare goalkeeper-with-neon-ears mashup. Chiliz.

🎹 Polkadot’s JAM Upgrade Gets a Jazz Musician to Rewrite Consensus Charts

Core implementer Daniel Cukier says the Join-Accumulate Machine will swap Polkadot’s guts for a modular protocol where services riff natively at layer zero. Thirty-nine teams code in isolation for prize money and bragging rights, ensuring interoperable results whether or not anyone sleeps. Polkadot.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending Protocol News 🏦

🔄 SafePal Embeds 1inch Swap API so Twenty Million Users Stop Price-Hunting Manually

Nothing like free gadgets to remind people cold storage exists for a reason. Hardware, mobile, and extension wallets can now route trades through 200+ chains with a single tap and minimal slippage. To celebrate, 300 limited Bluetooth X1 wallets land in a raffle for anyone swapping $50 via the 1inch path. 1inch.

🛠️ Aragon Joins Corn & Chiliz Support so DAOs Can Argue on More Chains

Democracy travels better when you sprinkle it on popcorn and football. The governance toolkit jumped onto Corn for Bitcoin-flavored DeFi and Chiliz for sports fandom, while a revamped proposal dashboard stops users from rage-clicking tabs. New veLocker perks will soon let token diehards lock bags straight from the app without copy-pasting addresses. Aragon.

🌐 Cronos Waves Its Cosmos-EVM Flag and Hits $493M TVL Without Breaking Sweat

Low fees, fast blocks, and DeFi Lego pieces - shocking that people prefer cents over gas-guzzling chains, huh. VVS swaps, Veno liquid staking, and Tectonic lending have 10,000 daily users farming fees with sub-second finality. Ethermint keeps Solidity devs happy while IBC pipes assets to the rest of the zoo. Cosmos.

🍰 PancakeSwap and Coinbase One Restart $4,200 CAKE Airdrops Every Fortnight

Trade $100 on Base, BNB, or Arbitrum through the DEX, verify wallet, and pray volume share nets more than crumbs - capped at 100 CAKE, of course. Zero-fee Coinbase members milk on-chain perks while liquidity mining returns to 2021. Sugar rush lasts until mid-October. PancakeSwap.

🤖 Balancer’s reCLAMM Promises Passive Concentrated Liquidity Without the Night Sweats

Automatic glide ranges, fungible LP tokens, and built-in MEV resistance turn JIT attackers into sad pandas. Retail farmers can stake once and ignore charts while claiming 200-plus-X capital efficiency. Balancer.

LINKS

Links That Don’t Suck 🔗

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Email me (Jonathan Morgan) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of crypto enthusiasts? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in ADA, IMX, COPI, MIN, AGIX, ALGO, ZEC, XLM, and NEAR. 📋