- The Litepaper by Stocktwits

- Posts

- 🐸 Frogs, Dogs, And BONKs Oh My: Memecoin Mania

🐸 Frogs, Dogs, And BONKs Oh My: Memecoin Mania

Bitcoin near ATH, memecoins going crazy, IBIT is bigger than silver, and a $16 million NFT

CRYPTO

🐸 Frogs, Dogs, And BONKs Oh My: Memecoin Mania

Ethereum is back to $3,600, Bitcoin hit new all-time highs against the Euro, and memecoins are going crazy. The bulls are on parade. 🟩

We're looking at a boatload of stuff in today's Litepaper: how close Bitcoin is to its all-time highs, the insane moves in PEPE, SHIB, and other memecoins, BlackRock's crazy AuM in its BTC ETF, and a very expensive NFT.

P.S. Over the next month, we’ll be transitioning our newsletter platform to Beehiiv. If you’re reading this, you’ve been switched over and may notice some changes as we tweak the formatting. To ensure our emails reach your inbox, please whitelist [email protected]

Here's how the market looked at the end of the trading day:

Bitcoin (BTC) | $66,800 | 5.78% |

Ethereum (ETH) | $3,588 | 2.83% |

Total Market Cap | $2.41 Trillion | 4.19% |

Altcoin Market Cap | $1.10 Trillion | 2.37% |

CRYPTO

Your Litepaper Just Got Moar Ossum

That's right. Your Litepaper is getting upgraded. 👍

You're getting two more days of the Litepaper: Tuesday and Thursday.

Monday and Thursday will be 'news' focused.

Tuesday, Wednesday, and Friday will be heavy on technical analysis, trade setups, and all that jazz. We'll have stuff for beginners and pros.

If you like or don't like this new schedule/setup, please reach out! Trolls welcome, I bathe in your hate, so don't hold back. 🫂

CRYPTO

So. Damn. Close.

Unless you've been sleeping off some horrible life decisions from last night, $BTC is insanely close to reaching its prior all-time high. 🚀

It's probable that by the time you read this, new all-time highs might already be in.

That's if $COIN doesn't mess things up again - because they did crash again today. Which, consequently, is one of those weird crypto beliefs: if Coinbase crashes its one of the signs of a new bull market.

As if Bitcoin's return to its ATH wasn't enough to figure that out. 🤷

CRYPTO

Frogs, And Dogs, And BONKs Oh My: Memecoin Mania

Memecoin madness is back, and it's like deja vu. All over again, like deja vu. 🐶

According to the fine folks at Santiment, the spotlight's on $PEPE, $FLOKI, $BONK, and a few others, all of which have decided to moon together. Price surges of over 500% and trading volumes that skyrocketed nearly 3,000%? Just another crypto memecoin insane bull run

📈 #Memecoins, particularly those that have been trending over the past week, have skyrocketed in trading volume due to surging prices and increased crowd interest. On average, $SHIB, $PEPE, $FLOKI, and $BONK has seen volume rise +3,000% in the past week. app.santiment.net/s/CtWj5RuX?utm…

— Santiment (@santimentfeed)

7:26 AM • Mar 4, 2024

But let's not forget our OG memecoins – $DOGE and $SHIB. They're not exactly sitting this dance out, posting gains of 120% and 288% since February 24 respectively over the past week.

Reminiscent of 2021's bull run frenzy, championed by Dogecoin with a cheer from Elon Musk, it seems memecoins are the life of the crypto party once again. Please don't take my word for it; look at the charts. You'll have to click on it to make the image bigger and zoom in with your fingers if you're on a phone. Here's how they've looked since February 24.

As I'm writing this, of course, $COIN decided to show off how they don't know how to scale crypto tanking and Coinbase tanking because Coinbase is down. Again. 🙄

CRYPTO

BlackRock's Bitcoin ETF Surpasses Silver Trusts with $10 Billion in Assets

When the first gold ETF came out, it took a couple of years to reach $10 billion in AuM (assets under management). How long did it take Blackrock's $IBIT? 2 months. 😱

Bitcoin spot ETFs have now eclipsed the largest silver trusts regarding assets under management (AuM), setting their sights on surpassing gold trusts next. According to recent data from HODL15Capital, BlackRock's IBIT has achieved an impressive milestone, amassing an AuM of $10.03 billion, translating to a remarkable year-to-date (YTD) increase of 35.2%.

Bitcoin ETFs are moving up the Commodity ETFs leaderboard.

Note the YTD performance difference of $IBIT $FBTC $ARKB $BITB vs. $GLD $IAU $SLV $GLDM $PDBC $SGOL $DBC $USO $UNG

— HODL15Capital 🇺🇸 (@HODL15Capital)

2:59 AM • Mar 3, 2024

This surge places the iShares Silver Trust ($SLV), with its $9.626 billion AuM and a 4.8% YTD decline, in the rearview mirror, marking a significant shift in investor preference towards digital assets over traditional commodities. Not far behind BlackRock in the crypto ETF space is Fidelity's WiseOrigin Bitcoin ETF, boasting an AuM of $6.55 billion and mirroring BlackRock's 35.2% YTD growth.

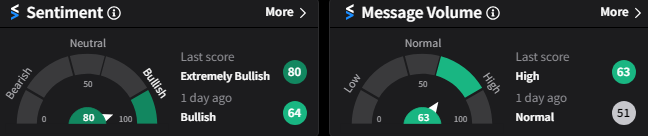

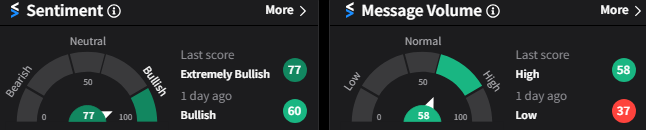

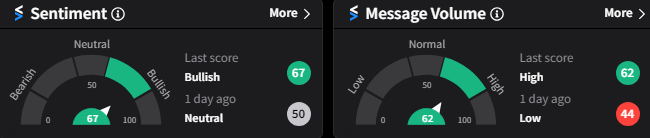

Stocktwits Sentiment Scores

How does the Stocktwits community feel about Bitcoin ETFs vs. silver or gold ETFs? Apparently, they like them both. A lot. 🤯

BTW - data on the Bitcoin ETFs is still very new, so we'll just use $BTC as the stand in.

Gold ETF ($GLD)

Silver ETF ($SLV)

Bitcoin ($BTC)

CRYPTO

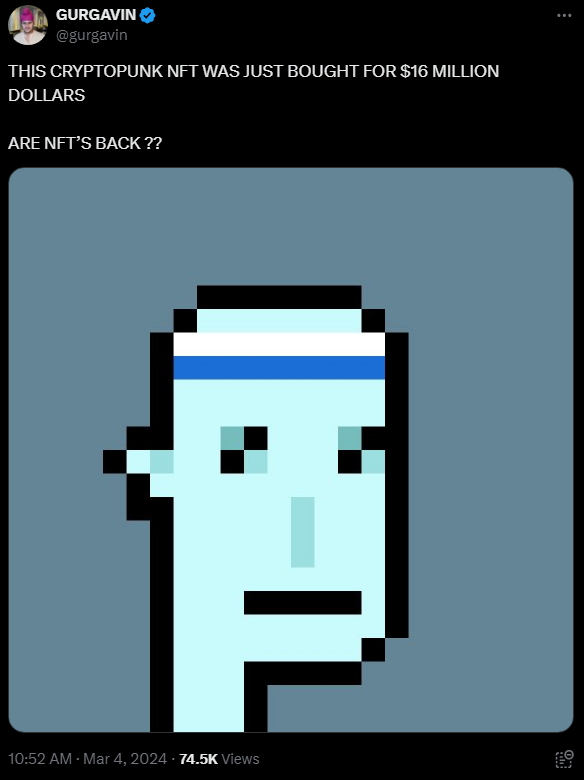

NFTs R Back?

Not much needs to be said here for this newsworthy event. 🤦♂️

Straight from the Gurg himself:

By the way, NFTs like this that are off center infuriate accountant minded people. People like The Daily RIP's Tom Bruni. Make sure to let him know.

LET’S GET SOCIAL

Follow Stocktwits Crypto

Crypto-hodlers rejoice. We created a crypto-specific Stocktwits account to stay up to date with the latest developments in the space. Be sure to follow us at StocktwitsCrypto.

Links That Don’t Suck

Get In Touch

Have feedback on The Litepaper? Email me (Jonathan Morgan) at [email protected]; I’d love to hear from you.

Want to sponsor this newsletter and reach tens of thousands of crypto enthusiasts? Reach us here.

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here.