- The Litepaper by Stocktwits

- Posts

- Gatekeeper Grift: Your Bank Balance Gets A Bouncer 😐️

Gatekeeper Grift: Your Bank Balance Gets A Bouncer 😐️

Reason #420 DeFi Is better

OVERVIEW

Gatekeeper Grift: Your Bank Balance Gets A Bouncer 😐️

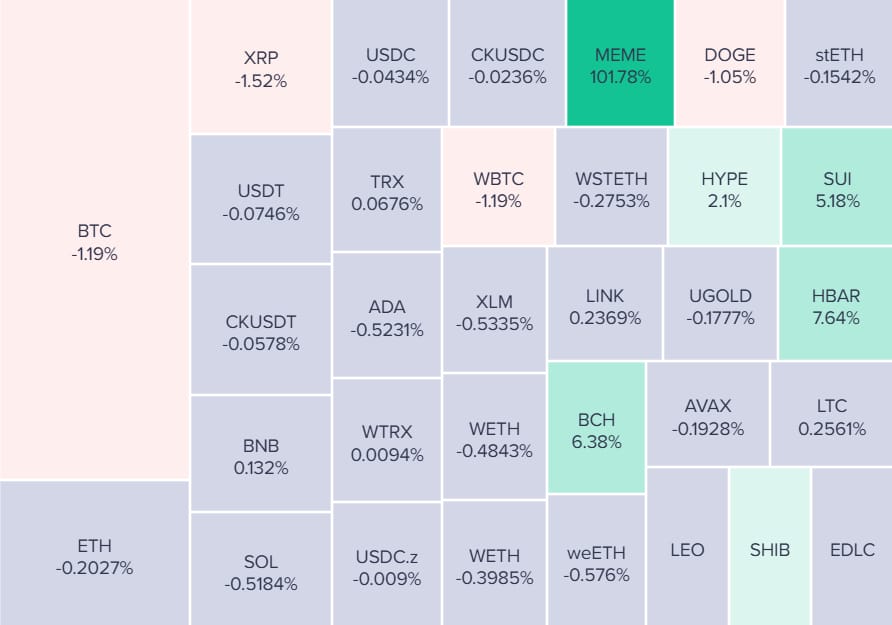

Before we dive in, here’s today’s crypto market heatmap:

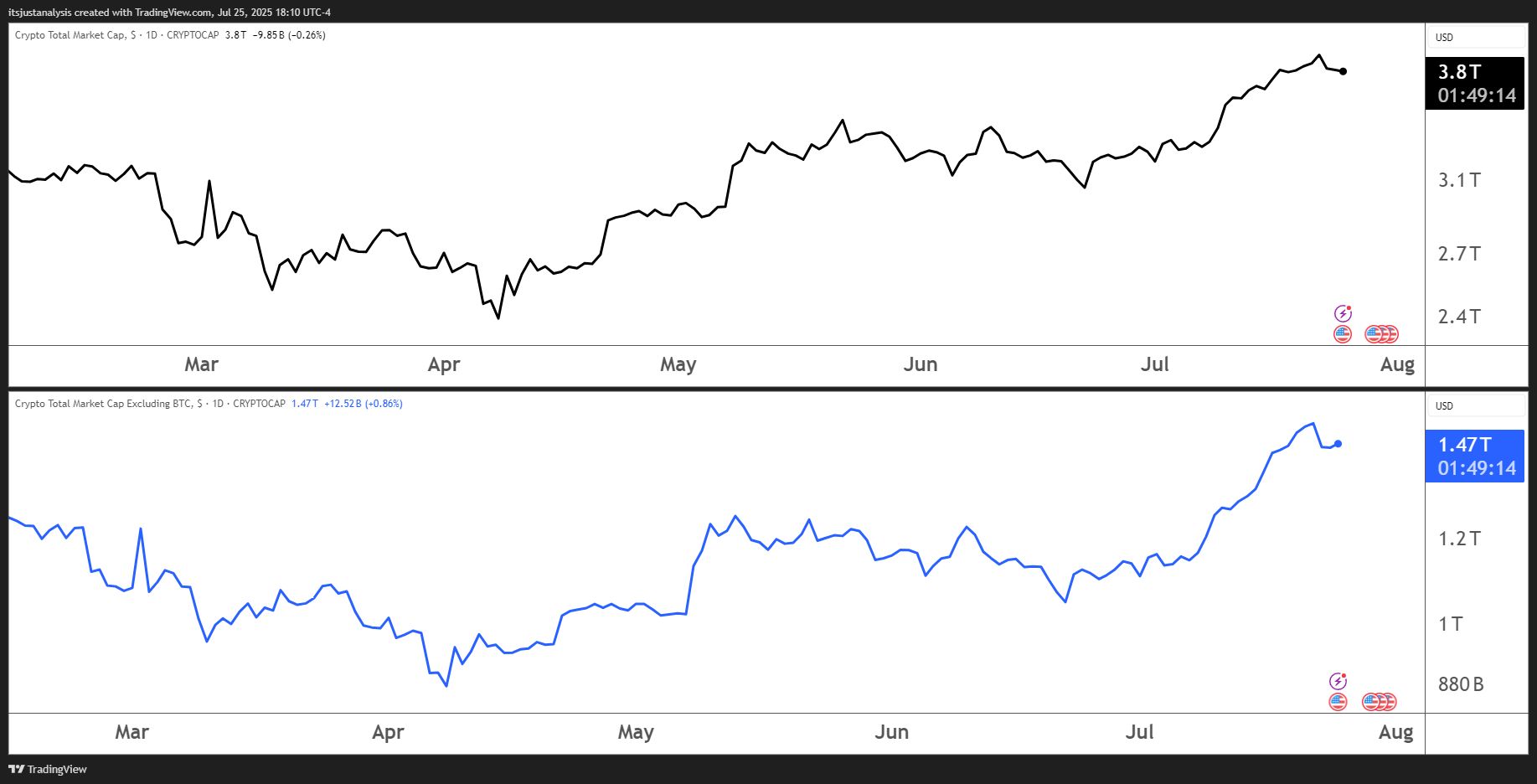

And here’s a look at crypto’s total market and altcoin market cap charts:

NEWS

Big Banks Want A Toll Booth on Your Data 🧌

If you thought Jamie Dimon’s “move fast, break fintech” act was just bluster, think again. 🤕

JPMorgan has now circulated price sheets that slap hundreds‑of‑millions in annual fees on the very data pipes that apps like Plaid, Coinbase, Venmo, and Robinhood need to function - because nothing says innovation like a Wall Street cover charge.

The Fee Grab 🤌

Bloomberg’s scoop: pricing tiers that spike for payment‑heavy use cases, i.e., anything remotely crypto‑adjacent.

JPMorgan’s PR line? “We’ve invested significant resources creating a valuable and secure system.” Translation: we’ve built a moat, now pay up to drop a drawbridge.

You can’t even blame the dinosaur for trying to outrun the asteroid - extinction is a heck of a motivator. But data isn’t a Jurassic Park exhibit. It’s ours.

Pushback, Trump‑Style 👊

Gemini’s Tyler Winklevoss lit the fuse on July 19, torching “banksters” for “trying to kill fintech and crypto companies” by turning free data into a toll road.

JPMorgan and the banksters are trying to kill fintech and crypto companies. They want to take away your right to access your banking data for FREE via-third party apps like @Plaid and instead charge you and fintechs exorbitant fees to access YOUR DATA. This will bankrupt fintechs

— Tyler Winklevoss (@tyler)

12:28 AM • Jul 20, 2025

Today (July 25) he revealed JPMorgan froze Gemini’s re‑onboarding because he wouldn’t shut up. So much for “productive conversations,” Jamie.

My tweet from last week struck a nerve. This week, JPMorgan told us that because of it they were pausing their re-onboarding of @Gemini as a customer after they off-boarded us during Operation ChokePoint 2.0. They want us to stay silent while they quietly try to take away your

— Tyler Winklevoss (@tyler)

6:38 PM • Jul 25, 2025

Meanwhile, a ten‑strong coalition of crypto and fintech trade groups fired a letter to President Trump on July 24, framing the fees as a “punitive tax” that sabotages his pledge to crown America the crypto capital of the world.

Here’s the kicker: big banks are simultaneously suing the CFPB to kill the very open‑banking rule that guarantees consumers free data portability.

They want lighter regs from the Trump administration at the same time they’re undercutting his fintech agenda. Pick a lane - or better, a reality.

Memory Loss on Wall Street 🧠

Dimon’s crew might want to revisit recent history.

After banks gleefully “de‑banked” Donald Trump and his companies post‑2020, they shouldn’t expect a rescue call from the Oval Office now. The President already signaled he’s more interested in ripping out banker middlemen than bailing them out, especially after they left him twisting when he needed credit lines most.

Actions, meet consequences.

Why This Matters for Crypto Folks 🤔

Fiat on‑ramps: If Plaid pays, Coinbase pays, and ultimately you pay in higher fees or slower transfers.

Competition: A pay‑to‑play gate locks smaller fintechs out, leaving only Too‑Big‑To‑Failosaurs at the table.

Innovation: Every dollar shoved into JPM’s moat is a dollar not spent on the next Lightning wallet or DeFi credit rail.

Big banks chose their side in the Government‑vs‑Trump cage match years ago. Now they’re shocked the referee isn’t rushing in with smelling salts. That’s rich - almost as rich as the rent they’re trying to charge for your own data. 🦖

ON-CHAIN ANALYSIS

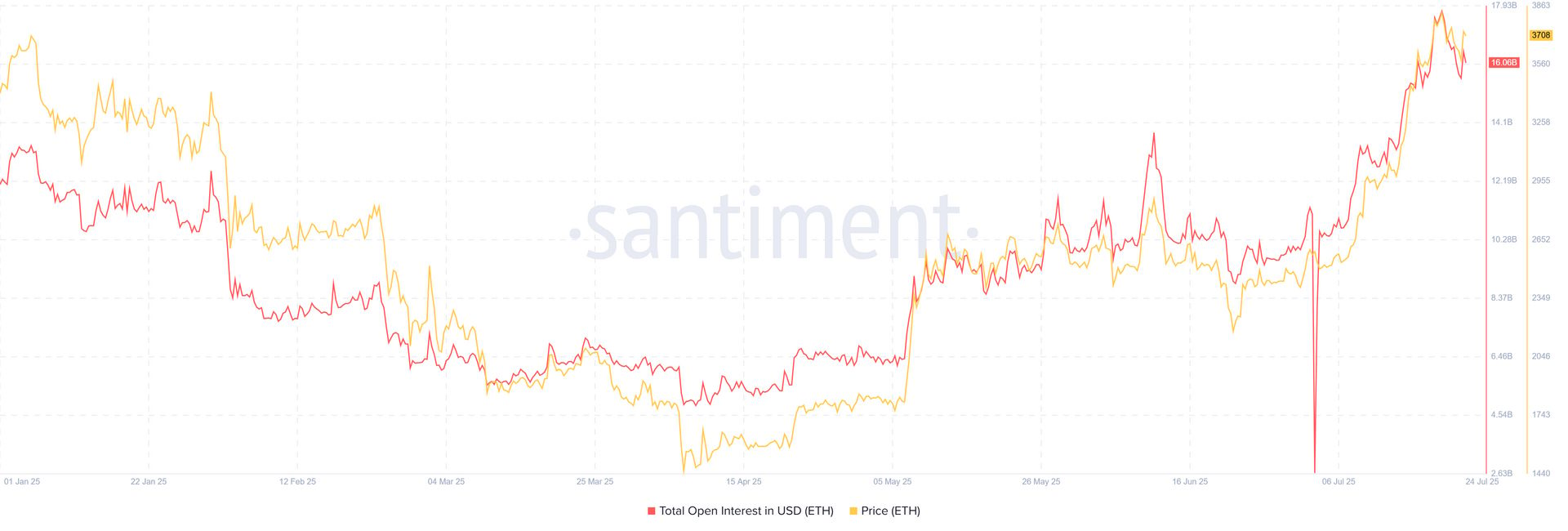

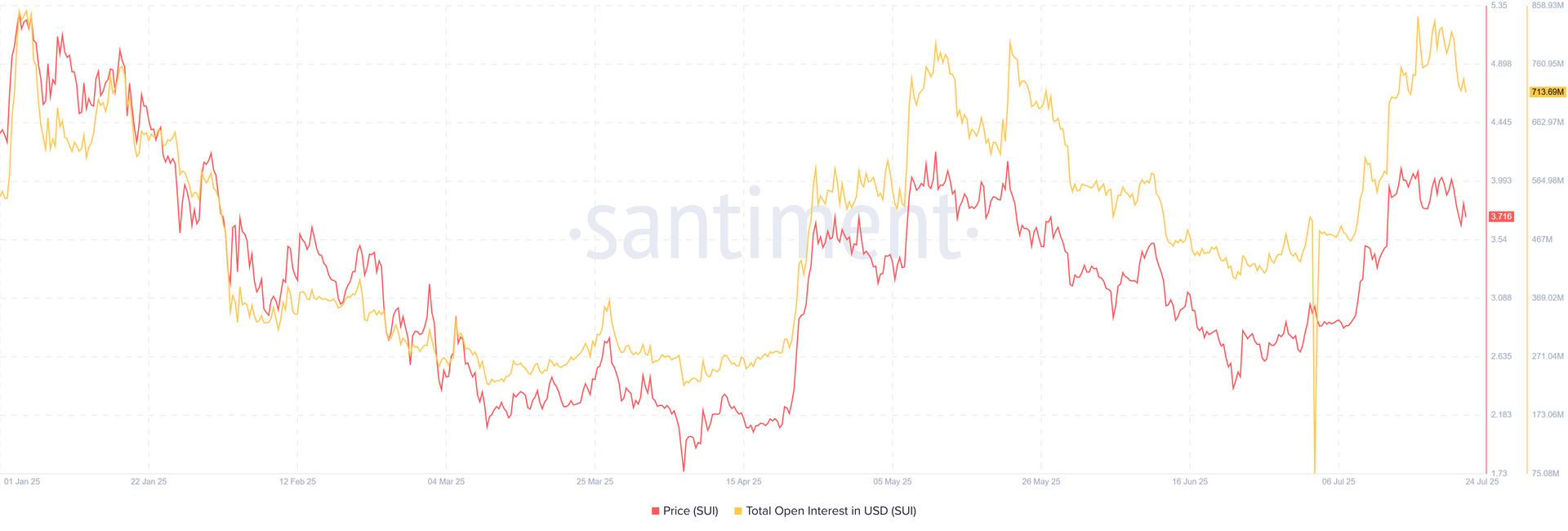

Leverage Thermometer Check‑In 🌡️

Open interest tracks how many futures contracts are still breathing. 📊

Big green number and rising price? Bulls flexing. OI pumping while price naps? Someone lit a leverage fuse. Price and OI both tanking? Margin calls already broke the door.

The table you’re staring at lines today’s OI against New Year’s baseline and each asset’s 2025 max so you know who’s bulking up and who’s cutting weight.

BTC - King With a Spare Tire 🛞

OI climbed a third since January, only 10% off July’s spike. Traders never fully de‑risked after flirting with six figures. If volatility wakes up, late longs become pavement pizza.

ETH - ETF Flow Micro-dosing Hangover Still Raging 🤒

Futures stack ballooned $5B YTD and sits 9% below Monday’s peak. Funding finally chilled, but the pile of leverage stays thick. Any gas‑fee tantrum could turn the crowd.

XRP - Regulatory Roulette Table 🎰

Open interest +45% on the year, yet already 25% under the hype top from last week’s episode. Headlines drive this market and OI says traders are still wired. One more court doc or insider sale and liquidation station might be next.

SUI - Narrative Front‑Run, Now Detoxing 🏃♀️

Hit leverage high in week one, bled 16% off that while price kept grinding. Book looks cleaner, but still 32% thicker than New Year’s. Less explosive, not risk‑free.

NEWS

Satoshi‑Era Whale Ditches 80K BTC - Galaxy Digital Mops Up the Mess 🐳

A crusty 2011 Bitcoin wallet finally woke up, rubbed its digital eyes, and dumped 80,201 BTC through Galaxy Digital for a cool $9.3 billion at Friday’s going rate. 😏

Quick Numbers 🔢

Total unloaded: 80,201 BTC

Already on exchanges: 61,697 BTC (Binance, OKX, Bitstamp)

Still sitting with Galaxy: 18,504 BTC ($2.14Bish)

Spot price as of press time: $116,700 (‑1.9% on the day)

ETF flows: +$226M Thursday, breaking a three‑day outflow streak

Old Money, New Liquidity 👴

Fourteen years in hibernation and this whale chooses peak ETF season to belly‑flop into the market. Galaxy says the $9 B trade ranks among crypto’s largest single exits - and yeah, that’s hard to argue when a single wallet basically printed the GDP of Fiji in one click.

Early chunks - 40,010 BTC on July 15, another 40,191 BTC on July 18 - set the stage. Friday’s 22,610 BTC splash plus a flurry of smaller dumps confirmed the cash‑out cadence. Traders prayed for a price nuke; Bitcoin yawned, slipped 2%, and kept hovering near six figures. Maybe whales just ain’t what they used to be.

This Could Have Been Worse… 3+ Years Ago 📆

Liquidity Stress Test: 30K BTC hitting order books inside hours and the market only droops 2% - score one for “mature” crypto markets.

ETF Cushion: Those fresh inflows probably soaked up a chunk of the sell pressure.

Whale Psychology: If a Satoshi‑era hoarder can bail with a straight face, maybe the “laser‑eyes until 2140” crowd should review their exit strategy.

Mike Novogratz is still chirping about $150K BTC by New Year’s Eve (ether to outperform, yadda yadda). Maybe he’s right - assuming the next dorm‑room wallet doesn’t decide it wants a mega‑yacht too. 🤑

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

💵 Native USDC + CCTP v2 Land on Sei

Circle now mints directly on the sub-400 ms L1; cross-chain transfers to 13 networks, 1:1 swaps, institutional on-ramps via Circle Mint. Legacy Noble-based USDC.n set to migrate. Sei.

🤖 Reactive Splits AI Brains from On-Chain Hands

Smart contracts stay deterministic; AI stays off-chain. Agents emit signals, ReactVM enforces budgets, roles, and timing - no private keys inside ChatGPT containers, no consensus nightmares. Cross-chain messaging built-in, ZK attestations on roadmap. Reactive Network.

💸 Frii Pay Turns XRPL into the Checkout Lane

Stablecoin tills, 3-second settlement, on-ledger coupons, and auto-FX via XRPL’s DEX. Already 900 UK merchants wired up, 50M+ terminals supported, and a University of Birmingham pilot where students tap phones for free coffee - all without touching card rails. XRP.

NEWS IN THREE SENTENCES

Real World Asset Tokenization (RWA) News 🪙

🏠 EleveX Joins MANTRA’s RWAccelerator to Tokenize Property

REIX marketplace slices senior-mortgage-protected real estate into tradable tokens with 24/7 liquidity and milestone payouts. €50M pipeline, 3,000 KYC investors on testnet. MANTRA provides compliance-ready layer-1 and Google Cloud credits. MANTRA Chain.

🏛️ BeToken Lists Regulated Spanish Equity on Polygon

ERC-3643 security tokens = real Beself Brands shares, KYC/AML baked in, dividends and votes on-chain, under CNMV’s blessing. Another notch in Polygon’s RWA belt after the Bhilai hard-fork >1,000 TPS and 5-second finality. Polygon.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending Protocol News 🏦

🗳️ Acala Opens LDOT Validator Elections & ACA Voting Rewards

Validators apply on forum + Discord; LDOT holders vote on-chain and split 200,000 ACA monthly. Liquid staking stays liquid while you farm extra governance tokens - double yield, zero unbonding. Acala Network.

⚡ COTI Uses Garbled Circuits to Stop MEV Liquidation Bots

Confidential DeFi finally gets a practical use-case. Liquidation rewards now hidden until inclusion, so flash-loan front-runners can’t copy your tx and steal the 10 % bounty. COTI Network.

🪙 BTCfi Goes Multi-Flavored on Sui

Five wrappers, five trust models - pick your poison and farm away. wBTC via Sui Bridge piggybacks Ethereum custody, LBTC funnels staked BTC yield from Babylon, xBTC lets OKX customers hop on-chain in one click, tBTC ships in with threshold crypto no-custodian vibes, and sBTC arrives by way of Stacks’ Proof-of-Transfer. Sui.

LINKS

Links That Don’t Suck 🔗

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Email me (Jonathan Morgan) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of crypto enthusiasts? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in ADA, IMX, COPI, MIN, AGIX, ALGO, ZEC, XLM, and NEAR. 📋