- The Litepaper by Stocktwits

- Posts

- Hackers Tripped Over Their Own Shoelaces 👟

Hackers Tripped Over Their Own Shoelaces 👟

Damage was lunch money. You still lock the door. Oh, and DOGE ETF coming Thursday?!

OVERVIEW

Hackers Tripped Over Their Own Shoelaces 👟

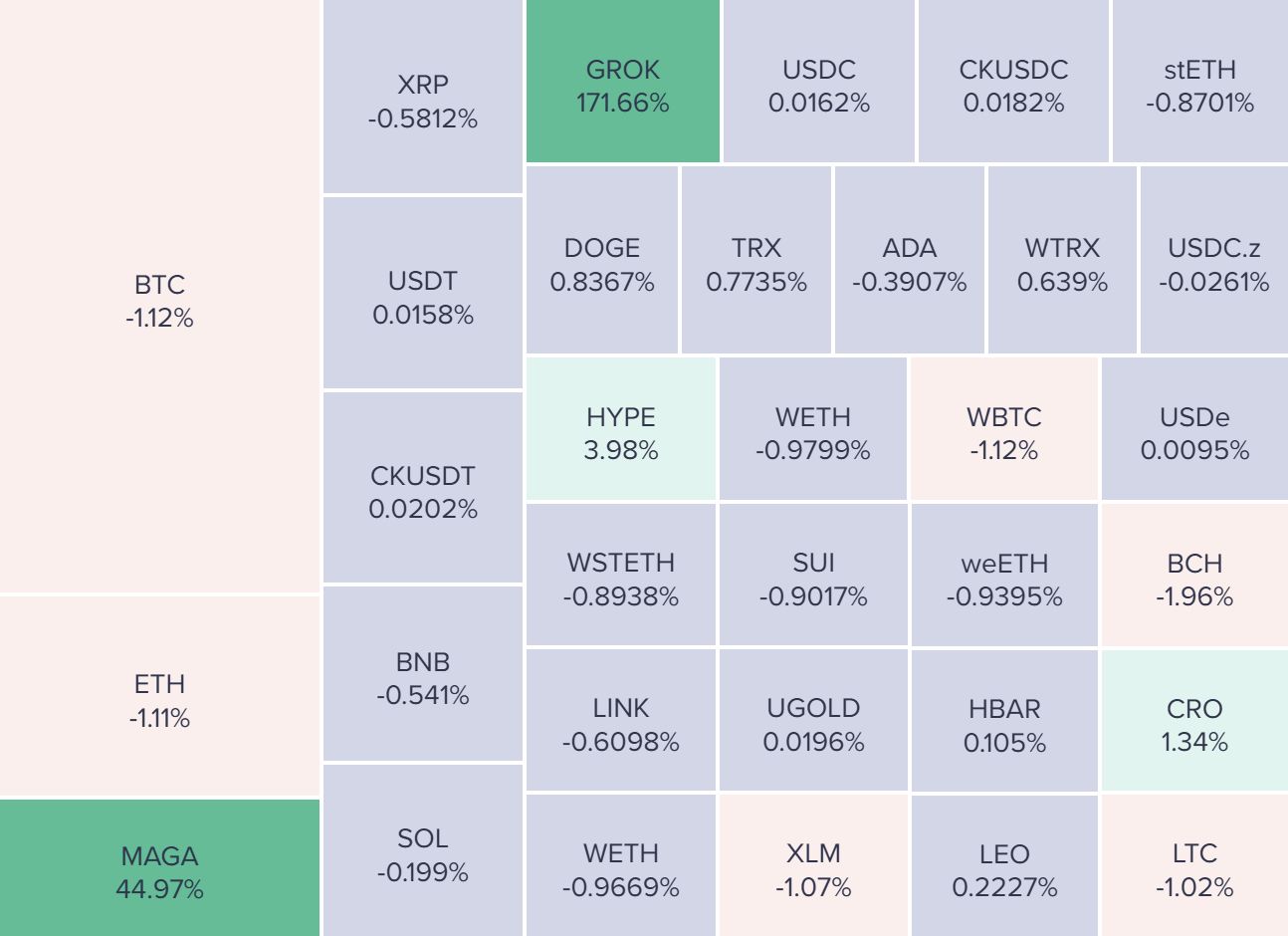

Before we dive in, here’s today’s crypto market heatmap:

And here’s a look at crypto’s total market and altcoin market cap charts:

NEWS

⚠️ Hack Update: Turns Out Crooks Can’t Code ⚠️

Remember that nightmare hack I screamed about yesterday? The one booby-trapping half the internet’s toolbox? Turns out the bad guys were their own worst enemy. 😂

What Happened

Think of it like this: they made a booby-trapped toy, but it only worked in a very specific kind of playroom. Most people use a different playroom. So instead of stealing coins, the trap just broke stuff and made loud noises.

Adults saw the smoke, realized something was wrong, and stopped it fast. 🛑

So almost nobody lost money - numbers are all over, it’s believed the amount lost was around:

Around $50.

Not $5,000, not $50,000, not $500k, but five-zero dollars. The crooks embarrassed themselves.

Ledger’s CTO basically said, “Congrats everyone, we dodged a bullet because the hackers forgot to test their own code.” Still, don’t get cocky. Browser wallets are the soft spot, so double-check those addresses on hardware devices and stay paranoid. 🫡

NEWS

Tom Lee Says $200K BTC By Christmas 🎄

Tom Lee on CNBC (I’m a poet and I didn’t know it) called Bitcoin at $200,000 by year end. 🚀

His entire case hangs on the Fed finally getting off pause and cutting rates again - because when money loosens, crypto doesn’t just move, it stampedes.

He framed September 17 as the trigger. That’s when the Fed could pivot, mortgages ease, stocks catch a bid, and suddenly every asset with a ticker goes vertical. Lee thinks BTC tags $200K, ETH rides the small-cap rally, and Q4 turns into a blow-off top insane-o price action fest.

Is it aggressive? Not really. Hell, a call out to $200k given some of the other predictions is conservative. But history lines up with him - every time the Fed comes back with cuts, equities run and crypto amplifies the move.

If Santa’s real, he’s pamping Bitcoin this year. 🎅

NEWS

DOGE ETF Incoming Thursday 🤯

If Bloomberg’s Eric Balchanus says it’s happening, it’s happening:

Meme coin ETF era about to kick off it looks like with $DOJE slated for a Thursday launch, albeit under the 40 Act a la $SSK. There's a big group of '33 Act-ers waiting for SEC approval still. Pretty sure this is first-ever US ETF to hold something that has no utility on purpose

— Eric Balchunas (@EricBalchunas)

11:47 AM • Sep 9, 2025

From Meme Dreams To Calendar Reality

REX-Osprey’s $DOGE.X ( ▲ 0.75% ) ETF got its post-effective amendment stamped with a September 9, 2025 effective date. Analysts are circling Thursday, September 11 for the actual listing.

Now, the REX DOGE ETF is a little different than the ‘standard’, ‘generic’ ETF. This REX ETF is a 1940 Act ETF, not a 1933 ACT - it’s the same process they used for the Solana Staking ETF that came out in July - $SSK ( ▲ 0.24% ).

For the spot DOGE ETFs filed by Grayscale and Bitwise, those deadlines are coming up in October and November, respectively. Let’s see what kind of activity the REX-Osprey DOGE ETF attracts on Thursday.

Oh, and the ticker listed for the REX-Osprey ETF is DOJE. 🐕️

Stocktwits users’ mood on Doge leveled up from 60 to 72 on Stocktwits, a big leap from bearish (48) a week ago. The chatter doubled from 31 (Low) to 62 (High). Translation: not only are people convinced, but they’re talking about it - a lot. 🧠

POLL

Take This Poll: Will ETH Lead Altcoins In September? 🤔

Kind of surprised to see how tight the Yes and No options are doing - pretty damn neck-and-neck.

A couple more days left to take the poll! 👇️

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

🎶 Decentraland Music Fest: $10K In Awards, Streamers To Stages

Nov 19 - 22, Genesis City goes full SUB/STREAM - a lineup built for Twitchers, VTubers, AI bands, and digital natives. Communities can claim Party Pads (festival clubhouses with $1K MANA + year-long builds), and performers can snag Main Stage slots ($500 MANA + promo). Referral program throws 500 MANA your way if your nominated crew gets picked. It’s Coachella minus the dust storms, and you get avatar drip and on-chain wearables minus the STDs. Decentraland.

🎲 CTN3 Turns Settlers Of Catan Into Web3 With Prizes

Colonist.io’s Catan now has a Web3 layer thanks to CTN3. Players can ante tokens into private lobbies, gamble in “Double or Nothing” mode, and chase loot boxes or NFTs from the CTN3 store. There’s even an airdrop. Picture building roads and settlements, but the winner walks away with a token pot - finally, board game night stakes higher than family bragging rights. COTI Network.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending News 🏦

📊 Pascal Protocol Wants To Clear $667T Of Dusty Old Derivatives

TradFi’s derivative stack is worth $667 trillion (yes, with a “t”), but on-chain it’s basically a ghost town. Pascal’s trying to change that with a Rust-powered clearing engine running on Arbitrum Stylus - think portfolio-level margin checks done by math, not middlemen. Their first swing, Jetstream, is live with Hyperliquid-style incentives, and they’re eyeing rate swaps, metals, and carbon markets next. Arbitrum.

⚡ Monaco Wants To Rebuild Wall Street On Sei

Imagine Robinhood, CME, and a Discord copy-trade group all jammed into one high-frequency DeFi stack that the CFTC and SEC definitely won’t give the go ahead to. With <1ms execution and sub-second settlement, Monaco is spitting out RFPs for builders: pro trading UIs, onchain CEXs, RWA platforms, prediction markets, even short-duration options with 1000x leverage (pretty sure that ain’t gonna fly here in the States). Sei.

NEWS IN THREE SENTENCES

Protocol News 🏦

🔧 IoTeX Upgrades Consensus, Because 3x More Decentralized Than Ethereum Wasn’t Enough

Welcome to group projects where slackers actually get docked points - that’s what slashing does for validators. IoTeX already had one of the highest Nakamoto coefficients around - basically, more people holding the keys, less chance of collusion. Now they’re rolling out IIP-50 through IIP-53: slash lazy validators, weight votes by actual stake, shrink signatures with BLS, and expand the delegate cap dynamically. IoTeX.

🐐 Jupiter Keeps Shipping: 2.5M Users, Gasless Sends, And 191K JUP Burned

Jupiter Portfolio just crossed 2.5M lifetime users, dropped an airdrop checker so you stop missing free money, and added .skr domain lookups for Solana Mobile Seekers. Verify v4 has already torched 191,000 JUP through express reviews, and Jupiter Send is now gasless - no SOL, no problem. On top, Jupiter Mobile v2 is out, calling itself the “DeFi Superapp.” Jupiter.

🌀 Balancer Expands To HyperEVM, Ships reCLAMMs, And Cleans Up Governance

Balancer v3 just landed on HyperEVM, dropping boosted pools and Gyro E-CLPs into a chain doing 200K - 400K tx/day. They also showed off reCLAMMs - auto-readjusting concentrated liquidity that keeps trades deep without babysitting. Governance greenlit a BVI entity for treasury ops, added new gauges, and handed out emergency subDAO powers. Oh, and veBAL yields a 31%ish APR, so governance is kind of a paycheck, too. Balancer.

LINKS

Links That Don’t Suck 🔗

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Email me (Jonathan Morgan) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of crypto enthusiasts? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in ADA, IMX, COPI, MIN, AGIX, ALGO, ZEC, XLM, and NEAR. 📋