- The Litepaper by Stocktwits

- Posts

- Only Took 1,374 Days 🤦

Only Took 1,374 Days 🤦

It's crazy but not so crazy it took this long for this to happen

OVERVIEW

Only Took 1,374 Days 🤦

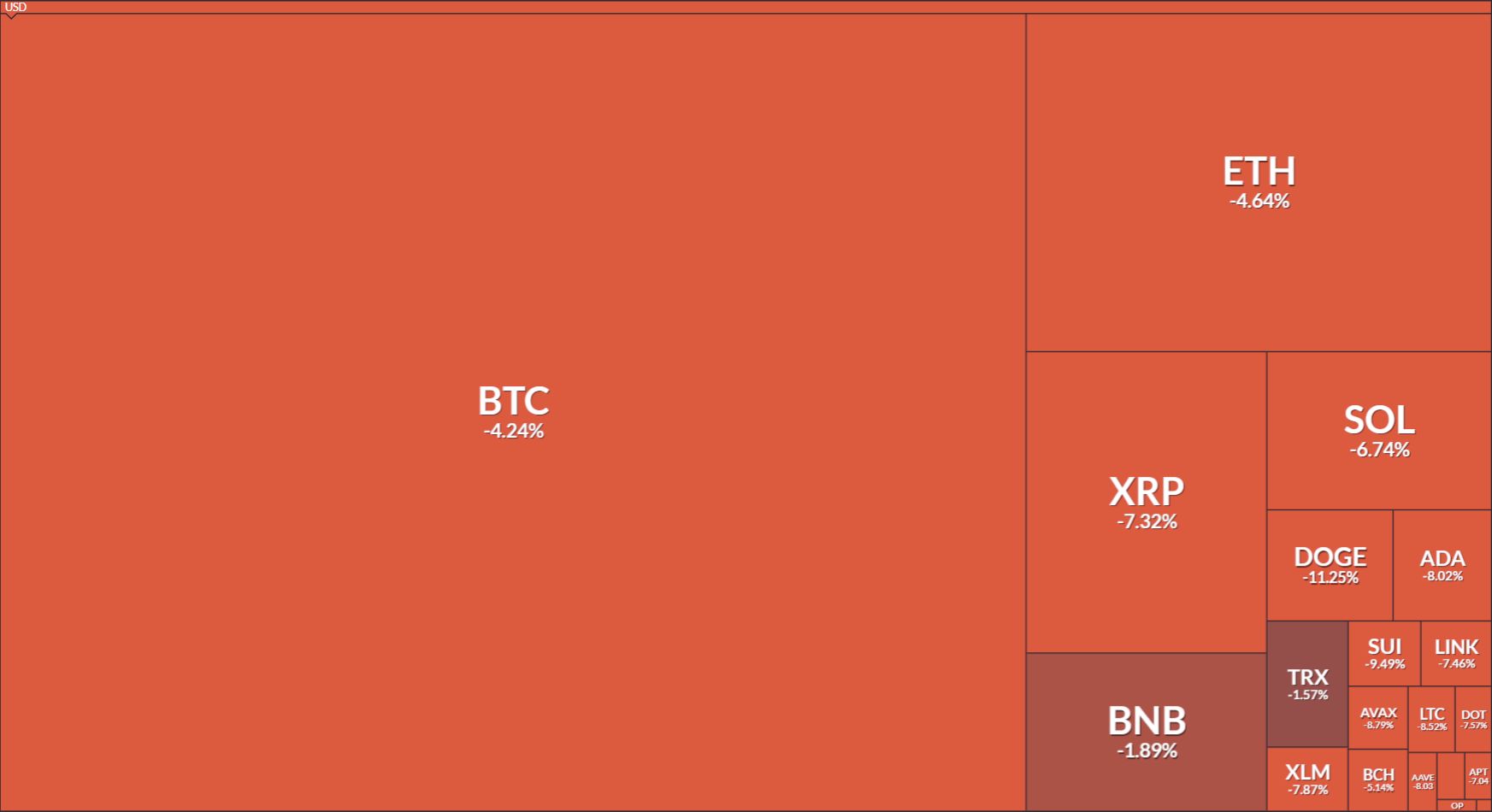

Before we dive in, here’s today’s crypto market heatmap:

And here’s a look at crypto’s total market and altcoin market cap charts:

NEWS

The US Government Is Not Buying Bitcoin?! 😱

To quote Treasury Secretary Bessent on Fox Business today: “… we’ve also started a, to get into the 21st century, a Bitcoin strategic reserve, we’re not going to be buying…” 💬

🚨BESSENT: WE ARE NOT BUYING BITCOIN

🇺🇸 US Treasury Secretary Scott Bessent says “we are not going to be buying” #Bitcoin — but confirmed the U.S. will keep confiscated assets as part of its BTC reserves. 🪙

— Coin Bureau (@coinbureau)

1:36 PM • Aug 14, 2025

After Bessent’s and the PPI numbers dropped, so did the the number leveraged long positions. How much in leveraged long positions were wiped out? About $440 million in under an hour? 🤯

Crypto social was filled with ‘OMG NO THE THE END IS NIGH’, but Stocktwits crypto users were mostly ‘meh’. I mean, there were your normal stonk market trolls hopping into the crypto streams on the Stocktwits app, laughing at BTC and crypto.

But just a reminder to crypto fans and haters alike, here’s a visual that shows the orange highlighted years where Bitcoin had the US government propping up it’s price by government purchases. The green highlighted areas show where Bitcoin did not have the US government purchasing BTC. 👀

Boom. 💥

SPONSORED

Your treasury is bleeding value. Saylor & Musk know the fix. Do you?

While you're sitting on cash, your treasury's purchasing power is getting rekt by inflation. Meanwhile, whales like MicroStrategy and Tesla have stacked billions in BTC, turning their balance sheets into goldmines. They're not just HODLing; they're making a strategic play against fiat debasement.

Ignoring this upside is the biggest risk of all. Ready to make the move? Don't ape in without institutional-grade security. BitGo provides insured, multi-sig, cold storage treasury solutions so you can secure your stack and sleep at night.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

TECHNICAL ANALYSIS

T-i-i-i-i-i-i-me, Why You Punish Me 🎶

Congrats to those of you who now have this classic Hootie and the Blowfish song stuck in your head for the rest of the night. You’re welcome for that. 🫡

Anyway, there hasn’t been much reporting on this stupidly important event that occured yesterday.

So, In Case You Missed It (ICYMI), yesterday’s close marked the highest daily closing price ever recorded for the altcoin market.

How long did it take for that to happen? It’s a damn brutal timeframe. So here’s the nitty gritty on the data to make it more painful.

3 years and 279 days OR 45 months and 6 days OR 198 weeks and 6 days OR…

1,374 days. 🤦

NEWS

Just Don’t Tell Anyone You Have Crypto 🤫

From Cointelegraph: Alena Vranova, the SatoshiLabs founder, Alena Vranova says at least one Bitcoiner/crypto person is kidnapped every week.

And it’s not just big whales and the stupidly rich getting picked up. She cited cases as low as 6k getting someone snatched and 50k getting someone killed.

The trend tracks price.

So if you’re like me, and you own crypto, or you write one of the largest crypto newsletters in the world and you basically broadcast you are a crypto hodler, what are you and me supposed to do?

Stop broadcasting. Kill geotags, humble the victory laps, and retire the “stacked another whole coin” selfie.

Harden the boring stuff. Cameras, motion lights, real door hardware, no predictable routines, and no “crypto bro lives here” package pile by the door.

Script the family. Safe word, simple plan, and who calls who. No surprises when adrenaline hits.

Device hygiene. Hardware security key, passkeys, no SMS 2FA, carrier SIM lock, and separate emails for finance and everything else.

Wallet structure that buys time. Use passphrase-enabled hidden wallets or decoy accounts if your hardware supports it. Keep a tiny surrender stash on a separate device. Never store the real seed at home as a single point of failure.

Multisig, properly. 2-of-3 with keys in different locations and at least one cosigner that isn’t physically tied to you. If you can, build time delays or require coordination you can’t satisfy under duress.

Reduce dox. PO box or virtual mailbox for KYC mail, data deletion requests where possible, credit freeze, limited paper trail.

Meetups and travel. Public places, daylight, no solo cash pickups, and no “quick ride” to somewhere “quiet.”

Tight mouth, tight circles. If someone “just curious” keeps asking about your setup, they’re not.

Review every quarter. If your stack changes, your threat model changes. Adjust.

Be safe out there. 🛟

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

🕶️ COTI Shields $ROSS From Solana MEV Mayhem

Ross Ulbricht tried to seed $ROSS liquidity on Raydium and bots farmed the mispriced pools like it was a buffet. Two snipes yanked about $12M after a CPMM vs CLMM mixup, so COTI rolled out garbled-circuit privacy to stop pre-confirmation exploits and keep DeFi trades dark until finality. Set the price once the block lands, not while a bot reads your transaction like morning news. COTI.

🧠 Band Launches Membit, A Real-Time Context Layer For AI

Give your AI a live feed of what the internet yelled five minutes ago and watch the takes age slower? Band wants your models to stop guessing the present with stale data and actually read the room. Membit streams curated social context in real time, pays “Data Hunters” to surface signal, and opens August 20 for builders and agents that need fresh intel. Band.

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

🎬 It Remains Launches Gas-Free On SKALE

Hell yes, a dystopia where the plot twist is the gas fee disappearing. The Hollywood-level transmedia franchise picked SKALE so fans can spam AR/VR quests and NFT votes without tipping the gas meter. The universe spans novels, XR mini-games, and a DAO with the RESISTER token, plus 120k followers and a sold-out collection that fetched 3–15 ETH across 17 countries. SKALE Network.

⚽ Olympique De Marseille Partners With Theta For AI And Validation

OM signed Theta EdgeCloud to power an AI fan assistant and then joined the enterprise validator set like a club that also refs the match. The bot runs on 30k+ decentralized GPUs with RAG over Ligue 1 data, while the team stakes THETA to help secure the network. When your mascot answers lineup questions and your node signs blocks, brand engagement finally comes with block rewards. Theta Network.

🗡️ Mirandus Rolls Out Trinket Slots, Buff UI, And Legendary Club

The on-chain fantasy grinder added three trinket slots, visible buff icons, and a finished Phoenix pet so your Exemplar stops faking it. Siphon of Chaos gives temporary crush resistance until shadow damage arrives, plus bronze weapons and a Legendary Brute’s Club drop into the world. Time to min-max and hope the RNG doesn’t hold grudges. Gala Games.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending Protocol News 🏦

💸 USD.AI Brings Tokenized GPU Financing To Arbitrum

USD.AI is minting a yield-bearing synthetic dollar to bankroll sub-$20M AI compute shops that banks refuse to touch. CALIBER turns GPUs into onchain titles for collateral, loans pay out in USDT, and beta TVL sits above $50M with pools headed to Uniswap, Balancer, and Curve. DeFi for racks and fans beats handshake leases and cap table tears. Arbitrum.

NEWS IN THREE SENTENCES

Protocol News 🏦

🧩 UXLINK Rolls Out EIP-7702 With Batch Calls And AI Audits

UXLINK shipped UX7702Delegator and ValidatorProxy so accounts can batch transactions, sign EIP-712, and roll back atomically when something breaks. ERC-1271 compatibility, multi-nonce replay guards, and ChainSpecter AI auditing land on Arbitrum One while aligning with EIP-4337’s account abstraction path. Less click-spam approvals, more programmable accounts your ops team can live with. UXLink.

🐳 Pocket Network Pushes Containerized Nodes For Leaner Throughput

Pocket says stop babysitting snowflake servers and ship your nodes in containers like you mean it. Slim images, CPU and memory caps, Kubernetes autoscaling, and Prometheus metrics tie into Shannon’s CU rebates so fleets scale while token burn drops. Runbook still have SSH and vibes? Expect your margins to follow your uptime. Pocket Network.

🧪 Sei Taps Pfizer Ventures’ Baran To Scale DeSci On-Chain

Sei hired Michael Baran of Pfizer Ventures to help its $65M Sapien Capital fund turn DeSci experiments into grown-up companies. The plan is Open Science rails on Sei for funding, data sharing, and coordination across health, longevity, and biotech. This guy definitely picked a goood time to exit the slaughterfest that biotech is these days. Sei.

LINKS

Links That Don’t Suck 🔗

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Email me (Jonathan Morgan) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of crypto enthusiasts? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in ADA, IMX, COPI, MIN, AGIX, ALGO, ZEC, XLM, and NEAR. 📋