- The Litepaper by Stocktwits

- Posts

- Stealth Wealth: Are Privacy Coins The Next Big Movers?

Stealth Wealth: Are Privacy Coins The Next Big Movers?

Privacy Coins the next big mover? Web3 gaming partnership, GBTC outflow slowdown, and a Technically Speaking

CRYPTO

🥷Stealth Wealth: Are Privacy Coins The Next Big Movers?

THE TOTAL MARKET CAP HAS RETURNED TO $2 TRILLION! 🟩

In today's Litepaper, we're looking at why Privacy Coins might be the next big movers, a big partnership in Web3 gaming, and the slowdown in GBTC's outflows.

Also on deck: a Technically Speaking over Mina, Injective Protocol, and yearn.finance.

P.S. Over the next month, we’ll be transitioning our newsletter platform to Beehiiv. If you’re reading this, you’ve been switched over and may notice some changes as we tweak the formatting. To ensure our emails reach your inbox, please whitelist [email protected]

Here's how the market looked at the end of the trading day:

Bitcoin (BTC) | $54,883 | 6.07% |

Ethereum (ETH) | $3,195 | 2.66% |

Total Market Cap | $2.02 Trillion | 4.64% |

Altcoin Market Cap | $952 Billion | 3.02% |

CRYPTO

Zcash And Privacy Coins Sleeping Giants?

Last week (February 20, 2024), Binance abandoned principles for profits and delisted the biggest privacy crypto by market cap - and, from a principled viewpoint, one of the most important cryptocurrencies that exist: Monero ($XMR). 🤬

Fun fact: The US Government and IRS hate Monero and privacy coins so much that in 2020, they issued two $625,000 bounties to anyone who could crack it. You can read that story here.

Privacy coins everywhere took a hit when Binance delisted Monero. According to our proprietary crypto index tracking, the Privacy Coin Index moved in the total opposite direction as the rest of the market:

But you might have noticed some privacy coins have had a little pump going on, specifically, Zcash ($ZEC). Why? Because Grayscale filed for a privacy ETF. And 10% of the allocations go into Grayscale's Zcash Trust. 🤯

Zcash

If there’s one crypto that can’t seem to catch a break, it’s Zcash. Shitcoin doesn’t begin to describe it. And compared to other altcoins, Zcash is old. If it were a dinosaur, it would be called Dookie-seratops or Shits-a-saurus Rex. Or something with poop. Poop-a-saurus. I made myself giggle.

How bad is Zcash? Well, on the weekly chart, it just made a new all-time lowest close on the weekly and daily charts in the first week of February, and the last time it made a new all-time high was over five years ago on January 6, 2018.

So if you're looking for something that's the very definition of high-risk, high reward, this might be one - or it's best not to put your hand in the stank and expect to find gold. 💩

CRYPTO

PUBG Publisher's Taps Circle for Crypto Integration

I used to enjoy PvP games, but after marriage and two kids, playing games like PUGB make me feel old. It's like I'm playing my Nintendo again for the first time and moving the controller up to jump Mario. I'm such a loser, and people scream at me in the game to let me know I suck. 🏹

But do you know what isn't a loser? PUGB's Overdare is partnering with Circle strategically. The BFF between Cricle and Overdare marks a significant milestone in integrating Web3 technologies within the gaming industry. By incorporating Circle's Programmable Wallets service, Overdare aims to provide in-game wallets with $USDC payouts to gaming content creators, facilitating a seamless transition from traditional gaming platforms to the Web3 space.

Circle co-founder and CEO Jeremy Allaire expressed enthusiasm for the partnership's potential to shape the future of digital entertainment, highlighting the importance of regulatory compliance and the creator economy in the Web3 ecosystem. 🕹️

CRYPTO

From Flood to Trickle: GBTC's Outflow

Grayscale's recorded its lowest daily outflow since becoming an ETF, with just $44.2 million on February 23. 💧

The decrease in outflows marks a potential turning point for GBTC, which has experienced a total of $7.4 billion in outflows to date. In contrast, other funds like Blackrock and Fidelity have seen substantial inflows, totaling $6.6 billion and $4.7 billion, respectively.

However, the landscape for GBTC remains challenging, as a recent bankruptcy court decision has authorized the sale of $1.3 billion in GBTC shares by the bankrupt lender Genesis to repay its creditors but Digital Currency Group (DCG, Grayscales' parent), is contesting the decision. DCG's objection centers on the valuation method for Genesis creditors' claims, advocating for a valuation based on crypto prices at the time of the bankruptcy filing. 📉

CRYPTO

Technically Speaking - February 26, 2024

Bitcoin hit $54,000, bla bla bla, and Ethereum hit $3,200. Yes, that's awesome, but if you're like me, I want to know what hasn't moved yet or is about to break out or, even more importantly, what might be hitting some profit-taking/reversal zones. 💡

Also, if you want to learn, check out our Ichimoku 101 article here, or watch this instructional video here.

Make sure to check out the screenshots, too, because there are price levels of importance that analysts and traders have identified as important.

If you want to go dumpster diving for treasure, this might be one. On Saturday, $YFI looked poised to complete the first Ideal Bullish Ichimoku Breakout on the daily chart since October 23, 2023. However, it failed to close above the Tenkan-Sen.

Yesterday, the same thing happened. Bulls are likely looking for anything close above the daily Tenkan-Sen, but because of a strong confluence zone of Fibonacci levels in the $8,441 value area, above that might be more attractive. Also, note the Kumo Twist that occurs between March 16 and 17. If YFI is trending strongly around that date, look for a change in direction. 🔦

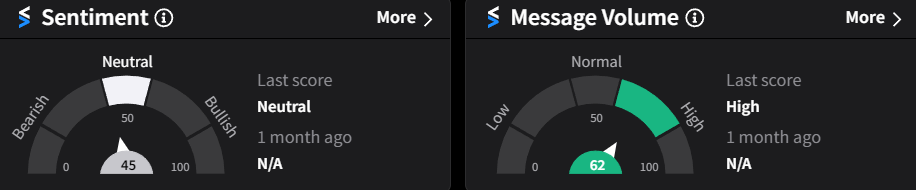

Stocktwits Social Sentiment Data for YFI

Mina

$MINA's daily chart shows a great example of a developing continuation move. The only thing missing is a daily close above the Tenkan-Sen and Kijun-Sen.

The Composite Index has crossed above its fast average, and if the momentum continues, it will move above its slow average as well - all of this after developing a hidden bullish divergence.

Additionally, the Detrended Price Oscillator's angle suggests it's about to cross above the zero line. Confirmation is key, and things only look good if bulls can pull off a close at or above $1.344.

Upside potential may be limited to a prior resistance area near $1.54. #️⃣

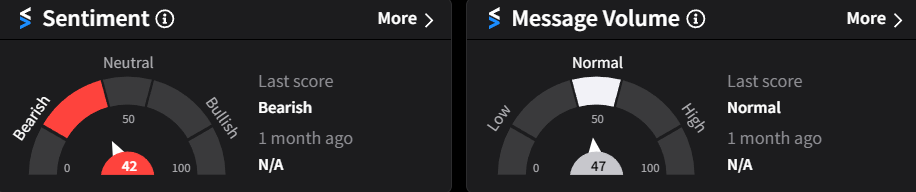

Stocktwits Social Sentiment Data for MINA

Injective Protocol

It's easy to forget that this monster of a mover gained $2,880% and was 2023's best performer. It's easy to forget because $INJ's been in a long consolidation zone since Christmas.

INJ is positioned perfectly for an Ideal Bullish Ichimoku Breakout - I mean it's one of the most perfect setups you can find. However, the same thing happened on February 18, but without any follow-through from buyers.

Will this time be any different? The proximity to the Kumo Twist suggests the answer is: yes. Complimenting the price action on any confirmed close at or above $36.63 are the Composite Index and Detrended Price oscillators, which would support any strong breakout. 👍

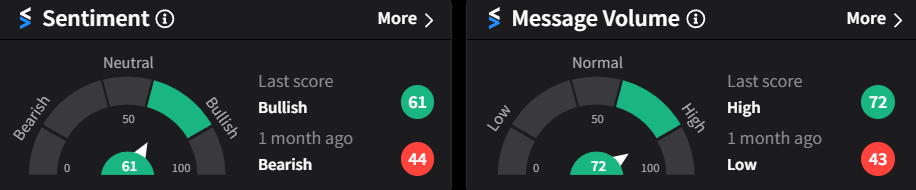

Stocktwits Social Sentiment Data for Injective Protocol

LET’S GET SOCIAL

Follow Stocktwits Crypto

Crypto-hodlers rejoice. We created a crypto-specific Stocktwits account to stay up to date with the latest developments in the space. Be sure to follow us at StocktwitsCrypto.

Bullets From The Day

🚀 MicroStrategy's BTC Shopping Spree Continues: Just when you thought your online shopping habits were bad, MicroStrategy slides in with a casual $155 million purchase of Bitcoin. Michael Saylor, the company's fearless leader, took to his X account to flex their latest crypto acquisition—3,000 BTC at an average of $51,813 each. This latest splurge brings their total BTC holdings to a whopping 193,000, acquired at an eye-watering $6.09 billion. Saylor, never one to shy away from a bold statement, hailed BTC as “the exit strategy,” underscoring their unwavering bullish stance.

🌈 Ethereum's Price Soars to 22-Month High: Ethereum, not to be outdone, has been painting the town green, hitting a 22-month high of $3,125. This milestone marks the asset's return to the much-coveted $3,000 club, stirring excitement and FOMO alike. ETH's impressive 36% gain over the past month has made it the bellwether of the crypto markets, which have seen modest gains. With eyes now set on the $3,350 target and an Ethereum ETF deadline looming in May, the stakes are high. As the crypto community watches Ethereum's historic monthly close, the message is clear: strap in because Ethereum's journey is far from over.

🤦♂️ This Faketoshi Just Won't Stop: The Crypto Open Patent Alliance (COPA) vs. Craig Wright saga unfurls in the UK High Court, new bombshells drop—not from the stand, but from Satoshi Nakamoto's digital past. Day 15 turns into a screenplay where Craig Wright's testimony becomes a sideshow to the main attraction: a treasure trove of emails between Satoshi and early Bitcoin pioneers Martti Malmi and Adam Back. The spotlight shifts to Malmi's GitHub reveal—emails that have dodged the public eye for over a decade, now laying bare the foundational dialogues of Bitcoin. The emails delve into Malmi's pivotal role and Satoshi's vision, from technical challenges to Bitcoin's capacity to rival Visa.

Links That Don’t Suck

Get In Touch

Have feedback on The Litepaper? Email me (Jonathan Morgan) at [email protected]; I’d love to hear from you.

Want to sponsor this newsletter and reach tens of thousands of crypto enthusiasts? Reach us here.

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here.