- The Litepaper by Stocktwits

- Posts

- Alts Climb All Week; Weekend Volatility Monster Looms 👾

Alts Climb All Week; Weekend Volatility Monster Looms 👾

Also: Trump signed the Genius Act today!

OVERVIEW

Alts Climb All Week; Weekend Volatility Monster Looms 👾

Before we dive in, here’s today’s crypto market heatmap:

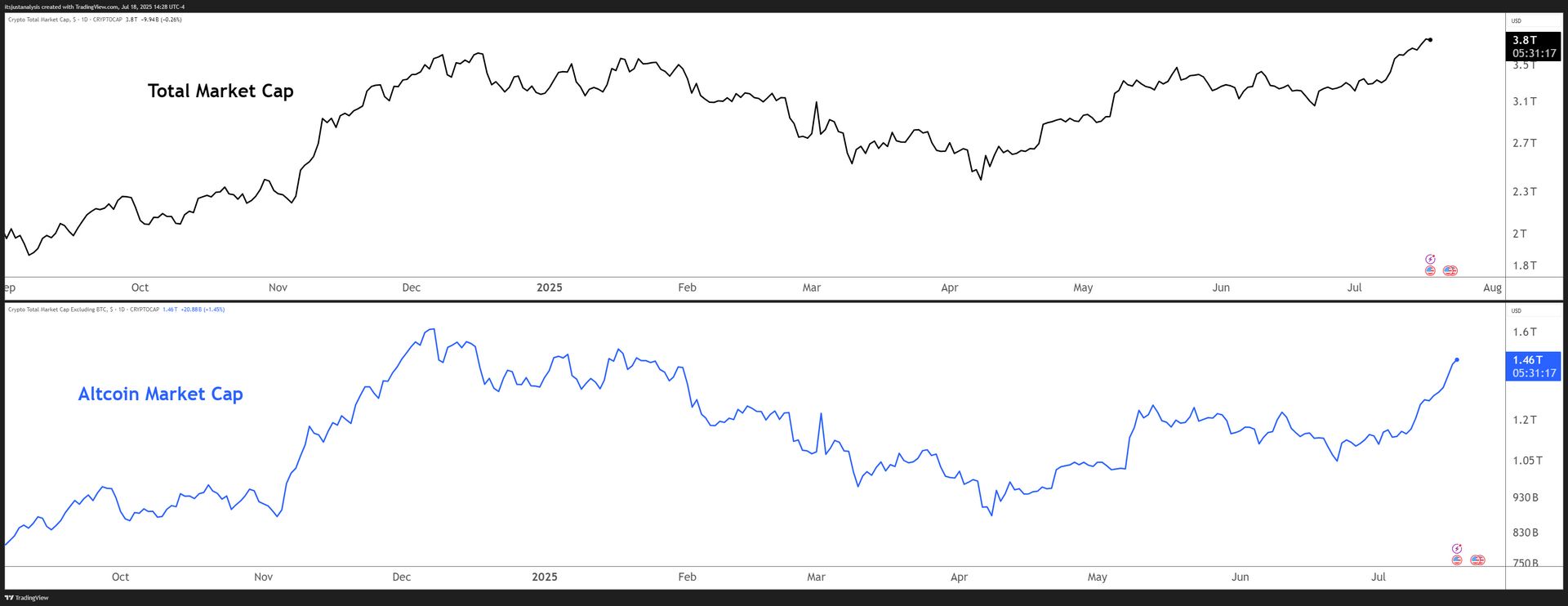

And here’s a look at crypto’s total market and altcoin market cap charts:

TECHNICAL ANALYSIS

Things You Might Not Have Noticed This Week 🤔

Total Market Cap

The crypto market’s total market capitalization hit a new all-time high of $3.92T.

Proof-of-Stake Market Cap

The Proof-of-Stake Market Cap is up +115% from its April 2025 lows and, unless something crazy happens, it will close this week positive YTD for the first time this year.

Bitcoin Dominance

On track to have it’s worst performing week since January 8, 2025. Deeper dive than the prior swing lower, but not as bad as the -11.32% drop in Nov - Dec 2024.

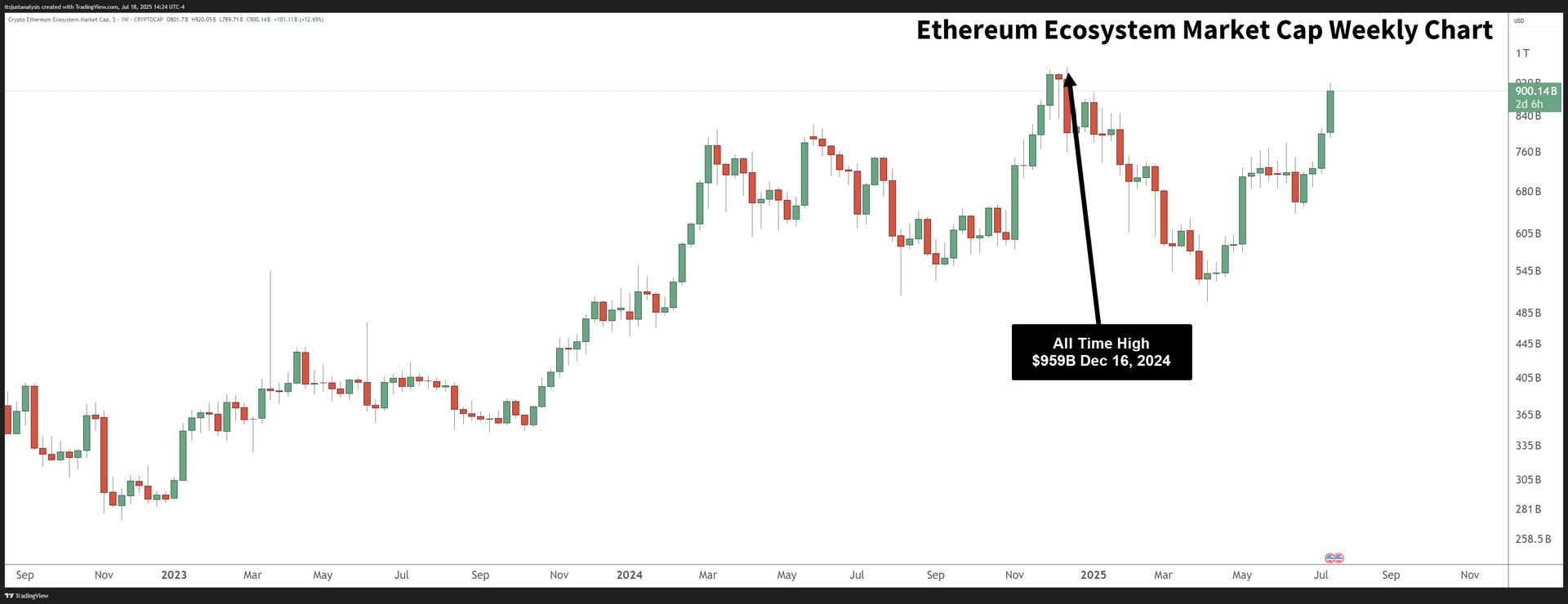

Ethereum Ecosystem Market Cap

ETH’s ecosystem hit $900B this week. It’s all-time high is at $959B.

ON-CHAIN ANALYSIS

See What’s In The MVRV-Z 👀

Quick reminder of what the MVRV-Z score is: it’s a sanity check on price. 🧠

It compares today’s market cap to the “realized” cap (what everyone actually paid for their crypto/tokens/).

Then it scales that gap by normal volatility and spits out a Z‑score.

What The Chart Means

Around 0 → price is about fair.

Above 3 → folks are overpaying.

Below ‑1 → it’s in the bargain bin.

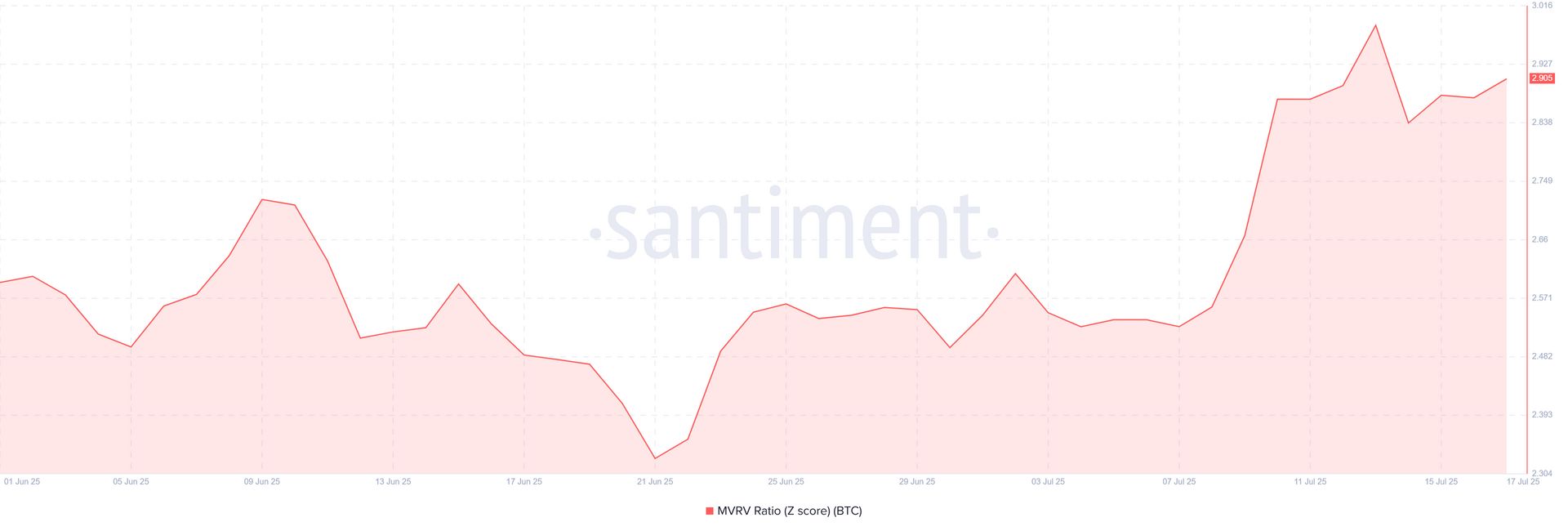

Bitcoin

MVRV Z crawled from 2.59 (June 2) to 2.90 (July 18), up 12%ish.

Every single day this period printed above 2, yet never cracked 3. Traders are excited, not hysterical.

Linear drift sits near 0.006 Z‑points per day - steady grind rather than parabolic launch.

Interpretation: BTC’s nowhere near the historical danger zone of 7+, but it’s inching that direction. If you’re long, cool; if you’re sidelined waiting for a deep value dip, keep the popcorn warm - you may be waiting a while. ⌛️

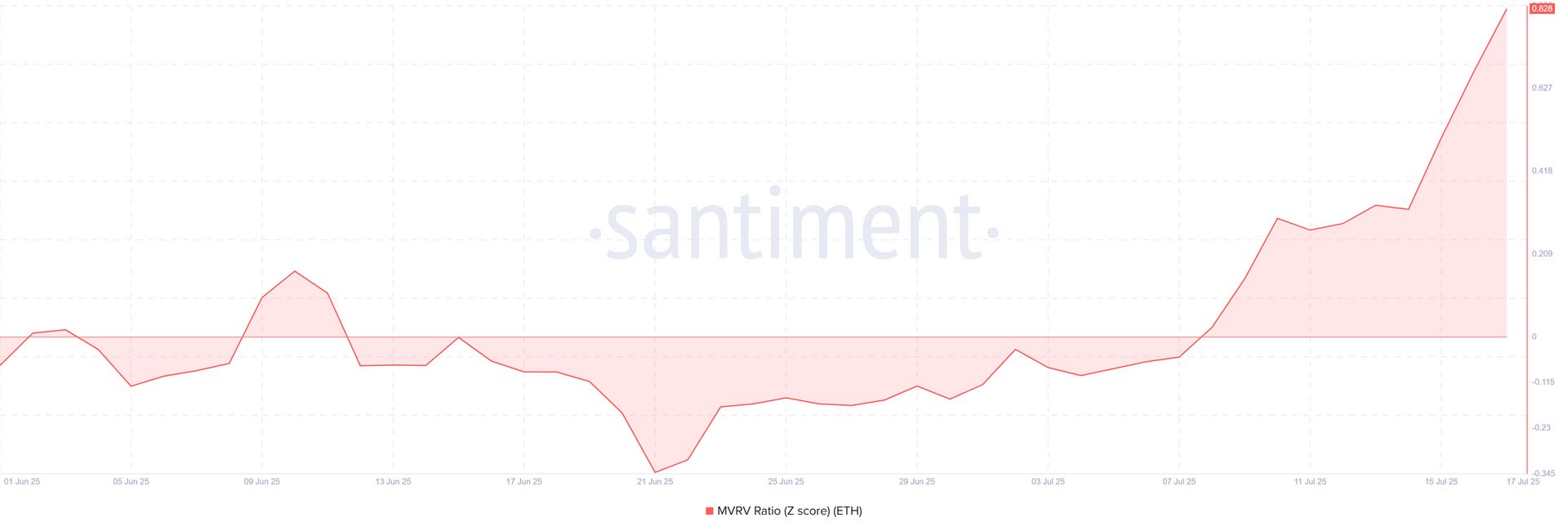

Ethereum

Started negative (‑0.07) and finished at 0.83. That’s a 0‑to‑hero jump of >1 Z‑point with a slope around 0.009/day.

Two‑thirds of the sample lived below zero; last week and into this week finally flipped decisively positive.

Translation: ETH just clawed out of the bargain bin and now trades at “fair” - not cheap, not frothy. Accumulation window’s closing, not slammed shut. 🪟

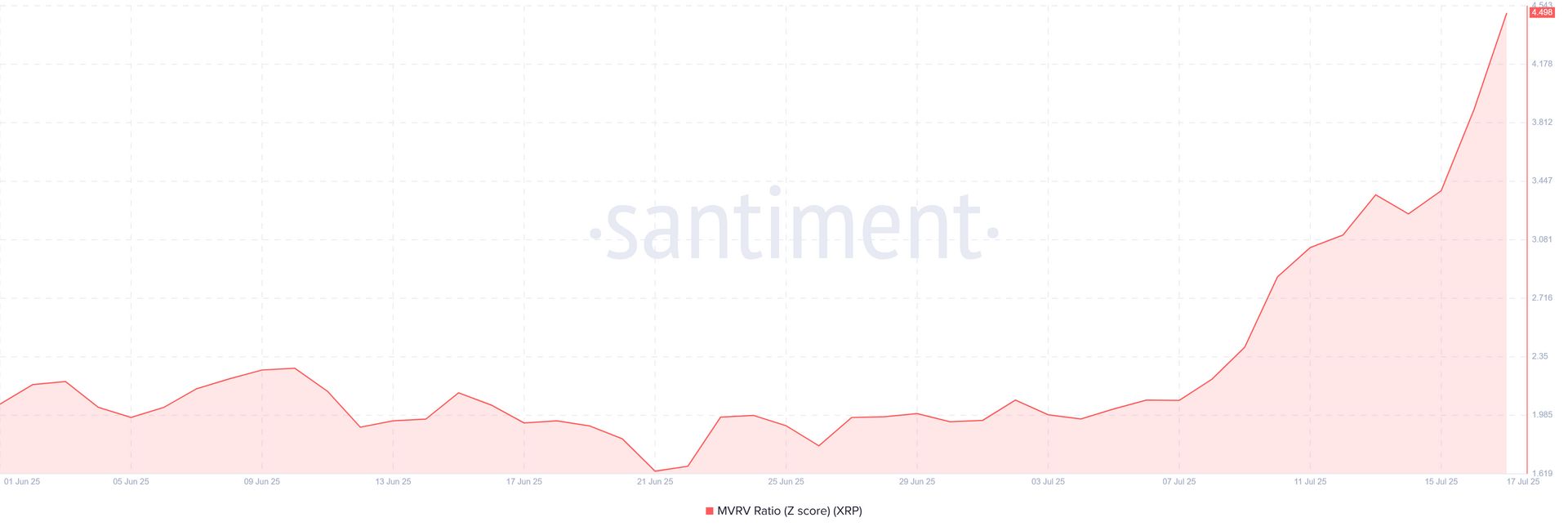

XRP

The show‑off: from 2.05 to 4.50 in six weeks, +119%.

14% of observations already sit above 3.

Prints keep making new highs, drinking straight from the euphoria punch bowl.

Takeaway: XRP is the only one flashing legit overheating risk. A reversal won’t surprise anyone except the bag‑holders convincing themselves it’s different this time. ⌚️

Cardano

Mean Z sits at ‑0.05, median negative as well. 62 % of days below zero.

Latest print 0.48 - the highest in the set and a ridiculous 8‑bagger relative jump from early June.

Bottom line: It moved, but statistically ADA’s still loitering near fair value. Anyone screaming it’s “overbought” needs a new calculator. 🧮

TL;DR

No chain here screams generational buy or catastrophic bubble - yet. BTC and ETH hover in the neutral middle, ADA’s barely shrugged off undervaluation, and XRP alone pushes the upper tail. 🪡

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

⚙️ Reactive Smart Contracts Crash HyperEVM, Because One Chain Wasn’t Chaotic Enough

Somewhere a DevOps engineer is Googling “vacation policy” because their automation pipeline jus Hyperliquid’s blister-fast dual-block chain now speaks Reactive Network, meaning bots can fire cross-chain hedges the moment liquidation snacks appear. Universal REACT gas plus HyperBFT security turns perp-sniping and delta-neutral vaults into copy-paste jobs. t automated itself. Reactive Network.

🪙 COTI Gives Aureus Gold-Backed Tokens a Privacy Cloak SWIFT Would Envy

Aureus’ Hedera-native platform tokenizes real estate and private equity, then COTI wraps each transfer in garbled-circuit stealth to dodge MEV. AUg settles one-to-one with shiny bullion while staying ISO 20022 compliant for the bankers in the back. Congrats Wall Street, you just discovered privacy coins. COTI.

✨ Sonic’s Spark AI Builder Promises “Describe App, Receive DApp”

Type a napkin idea, Gemini cranks out contracts, frontend, self-debugging loops, and live deployment - all scored for security before it ships. No-code DeFi, NFT marts, whatever: Spark builds it and teaches you why it works if you bother to ask. Web3 devs may need a new hobby once non-coders start shipping faster than they can. Sonic Labs.

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

🏟️ Chiliz Packs PSG’s Stadium With Hackers, Gives Out $150K and Swagger

236 devs from sixteen countries hacked Fan-Token utilities and SportFi DeFi at Parc des Princes, turning a football shrine into a code pit. Twelve winning projects now enter incubation under Chiliz, chasing glory alongside ex-players preaching Web3 gospel. I guess a week of Red Bull, Celsius and pitch-side selfies can recruit the next wave of blockchain builders. Chiliz.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending Protocol News 🏦

📡 CoinRoutes Hooks Uniswap

DeFi rails just slid into CoinRoutes’ dashboard, so traders can tap Uniswap and UniswapX liquidity while pretending they never left their compliance-approved workflow. The Uniswap Trading API dishes 4.6 bp better pricing across fourteen chains - laptop, tie, on-chain swap, done. Uniswap.

📱 Curve Sneaks Into Telegram Mini-Apps

TAC’s EVM layer on TON now hosts Curve, so a Telegram handle is all you need to park stablecoins and farm fees on your phone. The pre-mainnet campaign lured $700 million TVL, and TAC is showering pools with incentives to keep the party loud. Welcome to the future where your meme group chat doubles as a money market. Curve Finance.

🏦 Mantle Network Turns Two

EigenDA integration done, zkVM on deck, and UR’s crypto-fiat card aims to make Mantle the blockchain for banking rather than yet another DeFi sandbox. $MNT stakers grabbed millions in rewards, while hackathon “Cookathons” served bounties to 200-plus builders. Mantle.

🔍 Brave Search API Lands in AWS Marketplace, Feeds LLMs Fresh Web Junk

AWS customers can now bolt Brave’s independent index onto their agentic workflows and skip the “scrape Google, pray no lawsuit” phase. Real-time snippets from 30 billion pages show up in Bedrock AgentCore without leaving the console. Being the only search engine not owned by an ad behemoth pays off when every startup needs grounding data yesterday. Basic Attention Token.

LINKS

Links That Don’t Suck 🔗

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Email me (Jonathan Morgan) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of crypto enthusiasts? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in ADA, IMX, COPI, MIN, AGIX, ALGO, ZEC, XLM, and NEAR. 📋