- The Litepaper by Stocktwits

- Posts

- Your Anti-CBDC, CLARITY, and GENIUS Cheat Sheet ☑️

Your Anti-CBDC, CLARITY, and GENIUS Cheat Sheet ☑️

OVERVIEW

Your Anti-CBDC, CLARITY, and GENIUS Cheat Sheet ☑️

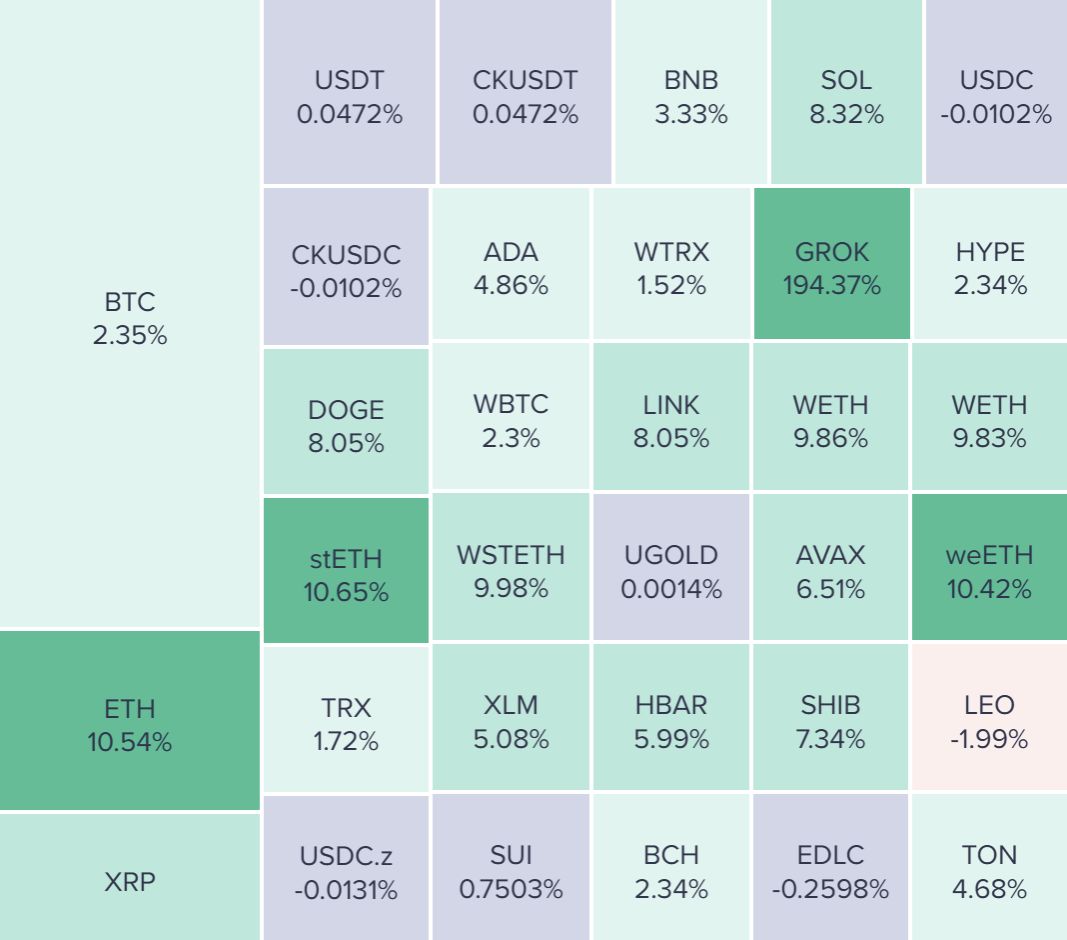

Before we dive in, here’s today’s crypto market heatmap:

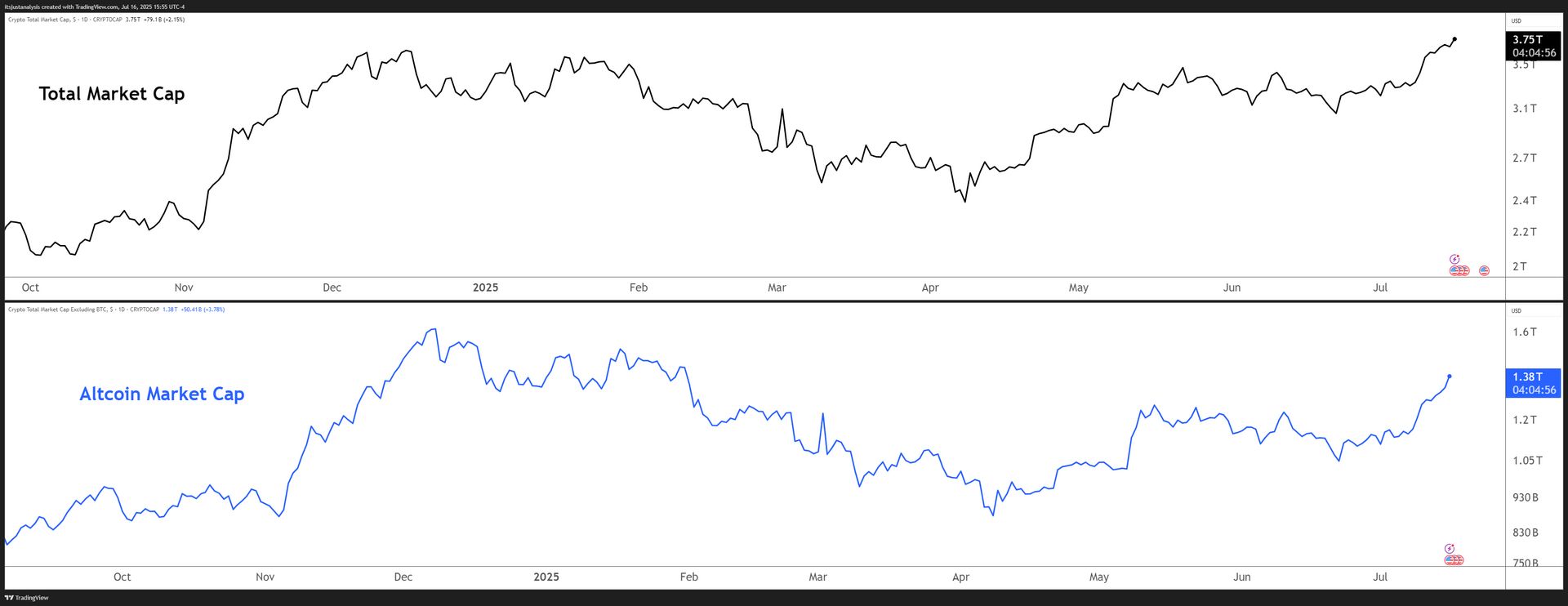

And here’s a look at crypto’s total market and altcoin market cap charts:

NEWS

Your Anti-CBDC, CLARITY, and GENIUS Cheat Sheet ☑️

More shenanigans in the House today. But before we go into the three bills expected to pass yesterday, today, sometime this week, here’s what’s happened so far today.🗳️

9 AM (EST) - Gavel hits, “Crypto Week” banner flying. GOP leadership gloats after Trump’s late-night knuckle-rapping flipped the last holdouts. No votes, just chest-thumps.

10 AM - Warm-up act. Republicans pitch privacy and “beat China,” Democrats yell “TrumpCoin grift.” Countdown to noon begins.

11 AM - Debate officially opens. GOP praises Anti-CBDC, CLARITY, GENIUS like they’re the Three Tenors. Dem amendments brought, politely shot on sight.

12 PM - Floor grows louder. $238B stablecoin stat waved around, surveillance boogeyman invoked. Rule vote queued.

1:15 PM - Procedural rule squeaks through 215-211. GOP high-fives, crypto market gets a tiny, short-lived spike.

2 PM - Spin cycle. Pundits note 100% partisan split, flag GENIUS Act as “closest to law.” Senate still the boss for the other two.

3 PM - Members fire off statements, Boebert runs an X poll, crypto maximalists declare victory, consumer-protection folks declare apocalypse. Cameras start packing up.

4:10 PM - Adjourned. Next stop: final passage votes penciled for tomorrow.

So, what are these bills and what’s in them? There’s a little over 1,000 pages combined, but today’s Litepaper breaks them down in as painless a way as possible. 🤕

NEWS

Anti-CBDC Surveillance State Act (H.R. 1919) 📑

No retail FedCoin - Bars every Federal Reserve bank from running wallets, holding balances, or issuing a CBDC straight to the public

No back-door FedCoin - Stops the Fed from piping a CBDC through commercial banks or fintech proxies

Research gag order

Fed may not test, study, build, or launch a CBDC

No using a CBDC for monetary-policy tweaks

Exempts open, permissionless, privacy-preserving dollar tokens

Congressional flex - States the Fed never had CBDC authority and won’t get it without a new law

Why it matters - Slams the lid on a surveillance dollar while letting crypto devs keep tinkering

Official Link: Anti-CBDC Surveillance State Act

NEWS

Digital Asset Market Clarity Act of 2025 (H.R. 3633) 📖

Definitions & provisional on-ramp - New legal terms across securities and commodities laws plus a grace-period registration so platforms don’t get perp-walked while rules cook

When a token stops being a security

Treats investment-contract assets as commodities once networks are “mature”

Sets compliant paths for primary/secondary sales and insider rules

SEC lane

Carves digital commodities and “permitted payment stablecoins” out of “security” status

Lets ATSs (Alternative Trading Systems) list spot crypto; updates record-keeping; tells SEC to chill on DeFi

CFTC lane - Spot exchanges, brokers, dealers, and custodians register with CFTC; mandates qualified custodians and a listing-certification regime

Innovation lip service - Codifies SEC FinHub, LabCFTC, and orders a stack of studies so Congress can claim it loves tech

Odds & ends - Savings clauses keep Howey alive; BSA (Bank Secrecy Act) and conflict-of-interest rules tag along

Why it matters - Draws a bright line between securities and commodities so crypto firms know whose phone to answer

Official Link: Digital Asset Market Clarity Act of 2025

NEWS

GENIUS Act - Guiding & Establishing National Innovation for U.S. Stablecoins (S. 1582) 📜

Issuer licensing - Three-year phase-in; only banks, credit unions, or state-approved non-banks may issue dollar stablecoins

Regulatory oversight - Licensed issuers face full bank-style exams by their primary watchdog

Reserve rules

1-to-1 backing in cash, Fed balances, insured deposits, or ≤ 93-day Treasuries

Rehypothecation mostly banned; narrow overnight wiggle room

Monthly attestations signed by CEO & CFO; lie and catch criminal charges

Redemptions & consumer protections - Clear redemption policy; only regulators can freeze withdrawals

Yield ban - No interest, staking rewards, or other yield on the coin

Custody - Reserves and private keys must sit with regulated custodians, off balance sheet

Bankruptcy priority - Holders jump the line; payouts start within 14 days if an issuer fails

Securities carve-out - Properly issued stablecoins aren’t “securities” or “commodities”; issuers aren’t investment companies

Treasury veto - Treasury can still block or sanction shady transactions

Why it matters - Sets a high bar for dollar-backed stablecoins while choking out yield-farm antics

Official Link: GENIUS Act

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

🤖 AI Agents Plot a DAO Takeover and Ask for Consensus Too

Researchers argue blockchains need a fresh behavioral consensus so autonomous agents can govern themselves instead of waiting for human thumbs. DeXe’s modular DAO stack already lets bot SubDAOs stake, vote, and execute once local thresholds clear. Great, your trading script may soon outvote you on whether to buy the dip. DeXe.

📊 The Graph Tells Low-Traffic Chains to Pay Their Own Way

Free lunch is ending at The Graph, and lazy chains without queries are about to discover intermittent fasting. Indexing rewards will now flow only to networks with real usage instead of slide-deck ambition. GIP-0084 rewires the Chain Integration Process so adoption, not aspiration, decides who gets GRT subsidies. The Graph.

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

🏅 Chiliz Includ3d Accelerator 2.0 Wants Your Web3 Sports Goodness

Chiliz kicked off Includ3d Accelerator 2.0 to school sports orgs on blockchain while handing out the first certification in tech, sport, and social impact. Apparently 180 teams yelling wagmi last season were not enough, so this round comes with Spanish and Portuguese tracks. Apply before month-end if you fancy turning fan chants into smart contracts. Chiliz.

🎮 World of Rogues Builds a Duolingo Streak On-Chain

World of Rogues just explained how its Duolingo-style streaks run on smart contracts and cross-chain callbacks. A StreakSystem logs daily claims, fires Reactive messages, and mints ERC-1155 loot when milestones hit. Imagine getting more consistent rewards from a wasteland RPG than from your actual bank. Reactive.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending Protocol News 🏦

🌊 Instadapp Fluid Turns Borrowers into Liquidity Farmers

Instadapp’s Fluid quietly turned idle collateral into overachieving capital while everyone chased meme coins. The system juggles $2 billion in assets, where Smart Debt earns trading fees and Smart Collateral keeps working up to 97 percent LTV. Next up is a modular DEX V2 on Arbitrum ready to make TradFi spreadsheets cry. Arbitrum.

🔗 MEXC Cuts the Bridge, Sends SKL Straight to SKALE

Ethereum bridges can keep their gas fees; MEXC just plugged SKL straight into SKALE’s Europa Hub. Users now jump from SKL trades to gas-free dApps in one hop, with a promo campaign dangling extra volume. First CEX to do it, and it makes paying chain fees feel like dial-up. SKALE Network.

LINKS

Links That Don’t Suck 🔗

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Email me (Jonathan Morgan) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of crypto enthusiasts? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in ADA, IMX, COPI, MIN, AGIX, ALGO, ZEC, XLM, and NEAR. 📋