- The Litepaper by Stocktwits

- Posts

- The Greatest Living Trader Says Altcoin Season Is Here 🤯

The Greatest Living Trader Says Altcoin Season Is Here 🤯

Also: What happened to the three crypto bills today and where they're going

OVERVIEW

The Greatest Living Trader Says Altcoin Season Is Here 🤯

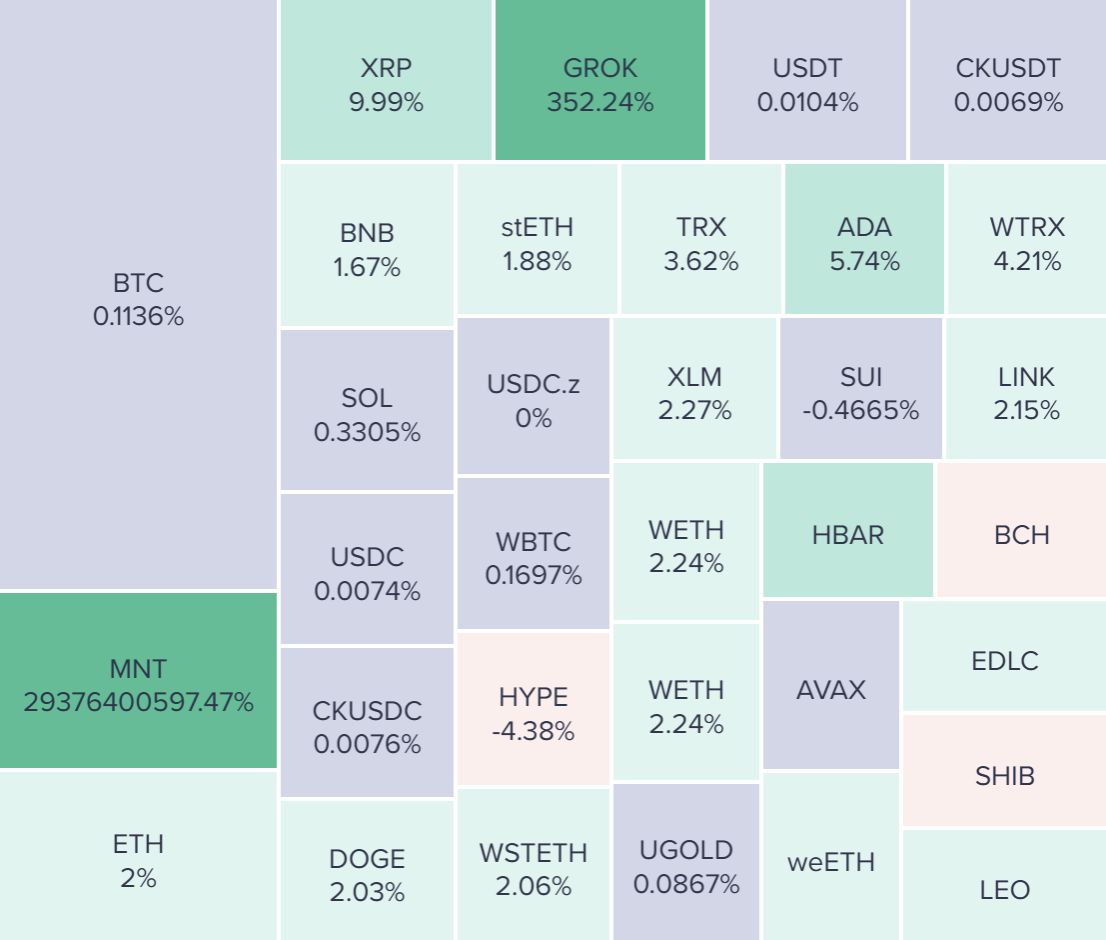

Before we dive in, here’s today’s crypto market heatmap:

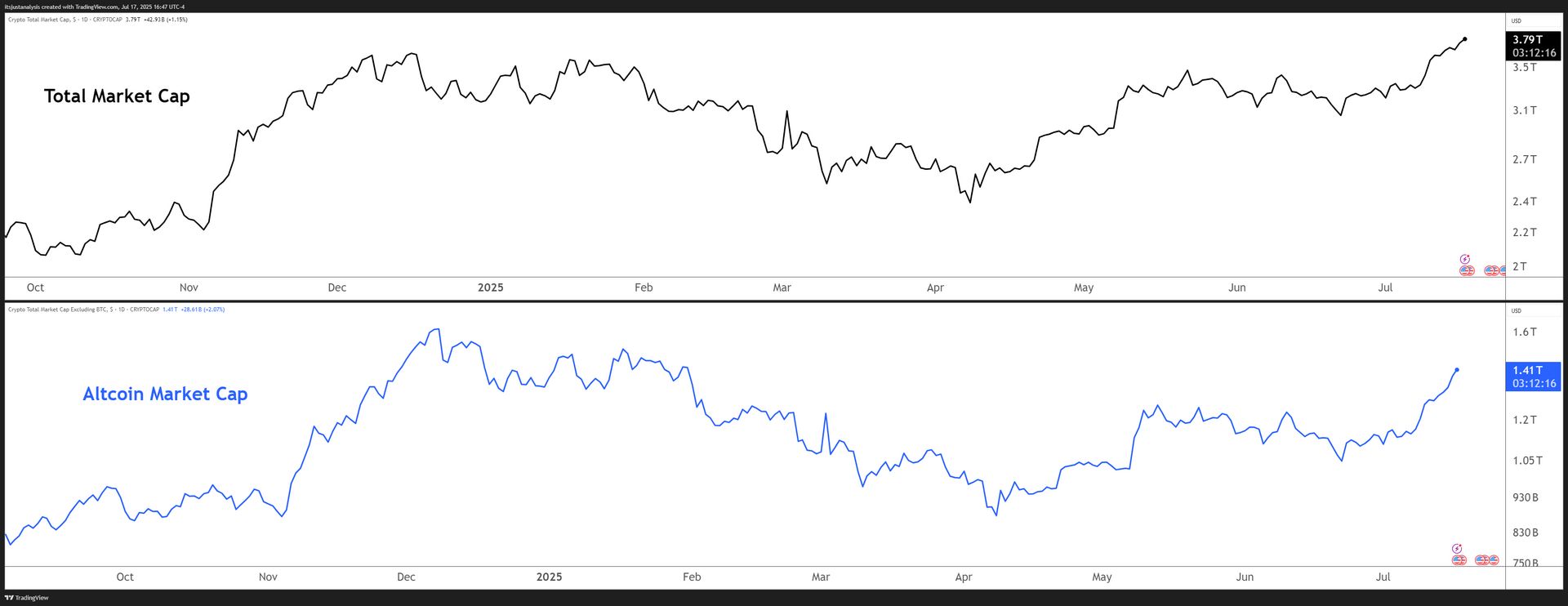

And here’s a look at crypto’s total market and altcoin market cap charts:

TECHNICAL ANALYSIS

When Peter Brandt Says Alt Season Is Here, Then It Probably Is 🧠

The great Peter Brandt posted this to his X account last night:

It's altcoin season

— Peter Brandt (@PeterLBrandt)

10:28 PM • Jul 16, 2025

If you don’t know who Peter Brandt is, well, let me give you a quick run down of why you should pay attention to what he writes/posts:

He’s been trading his own money, successfully, for nearly 45 years - most of us weren’t even developing eyelids yet.

He trades everything: grain commodities, currencies, stocks, and crypto.

He only uses the basic chart patterns: flags, pennants, head-and-shoulders, etc.

He shares his analysis and charts to anyone and everyone on social.

He has zero patience for trading bro’s, people showing screenshots of winning trades, and other ass-hatery like that.

Oh, and while I’m writing this, he quite literally just posted this 10 minutes ago:

So, what happens once when the last bite of the Big Yellow Banana is taken?

— Peter Brandt (@PeterLBrandt)

3:40 PM • Jul 17, 2025

Long story short: when the greatest and longest living trader says something is happening, probably a good idea to pay attention. 👍️

SPONSOR

What’s up with Bitcoin Depot’s Bitcoin treasury strategy?

Bitcoin treasury companies are red hot right now. It seems like the TradFi world is scooping up anything and everything crypto. But what about a company with a thriving business model and a growing Bitcoin treasury strategy? That’s Bitcoin Depot (Nasdaq: BTM), the world’s largest Bitcoin ATM operator, and they posted some impressive Q1 numbers — not to mention their stock price (up over 300% this year alone).

3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

The above is for general informational purposes only and is not investment advice nor does it constitute an offer, recommendation, or solicitation to buy or sell a particular financial instrument. Bitcoin Depot is not a registered investment adviser under the U.S. Investment Advisers Act of 1940. Nothing contained herein constitutes a solicitation, recommendation, endorsement, or offer by Bitcoin Depot to buy or sell any securities or other financial instruments

NEWS

Crypto Week Update 💡

If you want to know the deets of what’s inside the GENIUS, CLARITY, and Anti-CBDC bills, check out yesterday’s Litepaper. 👈️

Here’s what happened to each of them today, and where they’re headed.

GENIUS Act - The House passed it today, it goes to President Trump’s desk for signing into law as early as tomorrow.

CLARITY Act - The House passed it today, now it goes to the Senate.

Anti-CBDC - The House passed it today, now it goes to the Senate.

We’ll let you know as these votes continue to develop! 🧠

TECHNICAL ANALYSIS

Bitcoin's Dominance Continues To Slide 📉

This is bullish for altcoins. 🐂

It made a new two-month low and is on track to close the week for the lowest weekly close in four months.

Additionally, if this week closes in the red, it will mark the fourth consecutive week lower - the last time that happened was July 2022.

Altcoin’s are clearly chipping away at Bitcoin’s control of the market. Let’s see if they have enough momentum to sustain this trend. 🧠

NEWS

Canary Flies First Staked INJ ETF Into the SEC Coop 🐦️

Canary just flew the first staked INJ ETF into the SEC coop today, marking a pivotal moment in Injective’s march to the mainstream. 🚀

Institutional Heat Check

Ticker: Canary Staked INJ ETF

What it holds: Staked $INJ, earning on‑chain rewards while you sip coffee

Why you care: One‑stop, brokerage‑friendly access to Injective without messing with wallets

Context numbers:

Spot BTC ETFs hauled in $1.18 B of net inflows on July 10

New ETH ETFs grabbed $703 M in their first week

First European INJ ETP (21Shares’ AINJ) already trading, there’s demand there

Markets are fat with ETF FOMO, and Congress is knee‑deep in “Crypto Week,” pushing the CLARITY, GENIUS, and Anti‑CBDC bills. If those three clear the aisle, the compliance fog lifts and products like this staked ETF can run. 🏃

That Sweet, Sweet Staking Income

Institutional doors swing wide when the product stakes on your behalf. Yield flows back to hodlers, the Injective network gets extra security, and traders skip the cold‑sweat private‑key routine.

Add heavyweight validators like Google Cloud, T‑Mobile, and BitGo sitting on the council, and Wall Street’s risk officers suddenly sleep better. Maybe the compliance people, too (but probably not).

Injective Labs also lobbed a policy comment straight at Commissioner Hester Peirce, outlining a do‑no‑harm path for DeFi.

Translation: they’re playing the regulatory game instead of yelling from the cheap seats. Canary’s filing piggybacks that goodwill, positioning INJ as one of the few tokens with a legit U.S. ETF shot - joining a club that, for now, fits on a sticky note. 📒

SPONSORED

Stocktwits Acquires Thematic. Here’s Why That Matters.

📢 Big news: Stocktwits has acquired Thematic, an AI-native research platform. This is a major step forward in how we help investors discover ideas, screen for opportunities, and act with confidence.

By combining Thematic’s AI tools with years of market conversations and sentiment trends, we’re creating a smarter investing experience, one that surfaces personalized insights right when they matter most.

What’s coming:

→ AI-native search

→ Smarter trade idea discovery

→ Stream summaries

→ Institutional-grade index builder

→ New sentiment tools like Social RSI

More to come soon.

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

🛡️ Civic Ships Python Support and OAuth

Apparently “passwordless sign-in” is the new avocado toast for dApps. Quarter two brought account-linking, remote server auth, and prize money for anyone slapping Civic Auth into games, trading planets, or splitting bar tabs. Podcast cameos and Solana attestation press didn’t hurt the PR blitz either. Civic.

NEWS IN THREE SENTENCES

Real World Asset Tokenization (RWA) News 🪙

🏢 BNB Chain Joins Ondo’s Tokenized Stocks Party

Over 100 US equities and ETFs will land on BNB via Ondo’s Global Markets Alliance, chasing liquidity without Wall Street closing bells. Interoperability standards and custody rules try to keep regulators calm. Bringing meme-coin traders one click closer to fractional Berkshire shares. Ondo Finance.

🏛️ Dusk Bags Every Finance License It Can Carry

Compliance just went protocol-level as Dusk piggy-backs on NPEX to score MTF, Broker, ECSP, and soon DLT-TSS coverage. Now tokenized treasuries, equities, and money-market funds can mingle under one legal roof instead of juggling siloed KYC forms. Funny how “decentralized” gets everyone excited until regulators show up with clipboards. Dusk Network.

🚀 NEAR Launchpad Schedules a Token Avalanche, Intents Included

Fixed-price and auction sales promise AI, DePIN, and RWA coins galore, all buyable in three clicks from MetaMask. A liquidity-boost program pairs market makers with fresh NEP-141 tickers so ghosts of low-volume past don’t haunt the charts. Brace for “token season” memes. NEAR Protocol.

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

🎬 Storj Tells Media Execs to Drop the Tape Drives Already

Survey says 79 percent of studios want cloud, yet half still stash most content on-prem because vendor lock-in nightmares. Storj’s distributed storage claims 90 percent cost cuts, 83 percent lower carbon, and zero “oops AWS just billed us a yacht” moments. Lift-and-shift without a plan? Enjoy recreating every bad decision at 3x latency. Storj.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending Protocol News 🏦

🍣 Sushi v3 Liquidity: More Fees, More Homework

Concentrated ranges pump yield as long as price stays inside your sandbox—drift out and you earn squat. Impermanent loss gets spicier, ratios ditch the 50/50 rule, and gas fees nibble re-positions. Lazy LPs can outsource headaches to Gamma or Charm while pretending it’s passive income. SushiSwap.

📊 Sui’s Q2 DeFi Stats Flex Harder Than Its Marketing Team

A virtual MasterCard and an ETF filing beat bear-market blues. Peak TVL punched past $2.5 billion in May while Bitcoin-flavored sBTC and xBTC turned hodlers into yield farmers. Bluefin, Cetus Pro, and Momentum kept firing feature cannons, even as some volumes dipped and others exploded 3,000%. Sui.

⚡ Stellar Shoots for 5,000 TPS - Hardware Stays the Same, Sweat Doubles

Protocol 23 introduces multi-threaded Soroban and parallel consensus so the network stops napping between ledgers. Caching, pipeline tweaks, and smarter benchmarking hope to unlock unused CPU before validators upgrade rigs. When throughput jumps, Horizon better hit the gym too. Stellar.

LINKS

Links That Don’t Suck 🔗

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Email me (Jonathan Morgan) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of crypto enthusiasts? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in ADA, IMX, COPI, MIN, AGIX, ALGO, ZEC, XLM, and NEAR. 📋